In the fast-paced world of finance, understanding the stock market is crucial for investors looking to make informed decisions. One of the most powerful tools at an investor's disposal is the stock chart. This article delves into the importance of stock charts, how to read them effectively, and provides insights into some of the most popular chart types.

Understanding Stock Charts

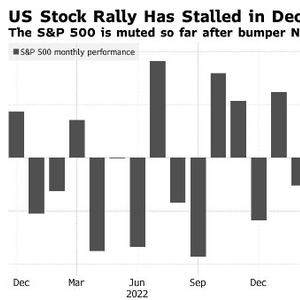

A stock chart is a visual representation of a stock's price movement over a specified period. It provides a snapshot of the stock's performance, making it easier for investors to identify trends and make predictions. By analyzing these charts, investors can gain valuable insights into the stock's potential for growth or decline.

Types of Stock Charts

There are several types of stock charts, each offering different insights into the market. Here are some of the most common:

- Line Charts: These charts display the opening, closing, highest, and lowest prices for a given period. They are the simplest type of chart and are often used for a quick overview of the stock's price movement.

- Bar Charts: Similar to line charts, bar charts also show the opening, closing, highest, and lowest prices. However, they provide a clearer picture of the stock's price movement by using bars to represent the price range.

- Candlestick Charts: These charts are similar to bar charts but use candlesticks to represent the price movement. The body of the candlestick shows the opening and closing prices, while the wicks represent the highest and lowest prices.

- Point and Figure Charts: These charts are used to identify long-term trends and are based on the principle that price changes are more significant than time. They do not show time, only price movements.

Reading Stock Charts

Reading stock charts effectively requires a basic understanding of chart patterns and indicators. Here are some key elements to consider:

- Trends: Identify whether the stock is in an uptrend, downtrend, or sideways trend. Uptrends are characterized by higher highs and higher lows, while downtrends are marked by lower highs and lower lows.

- Support and Resistance: These are price levels where the stock has repeatedly struggled to move above or below. Understanding support and resistance levels can help predict future price movements.

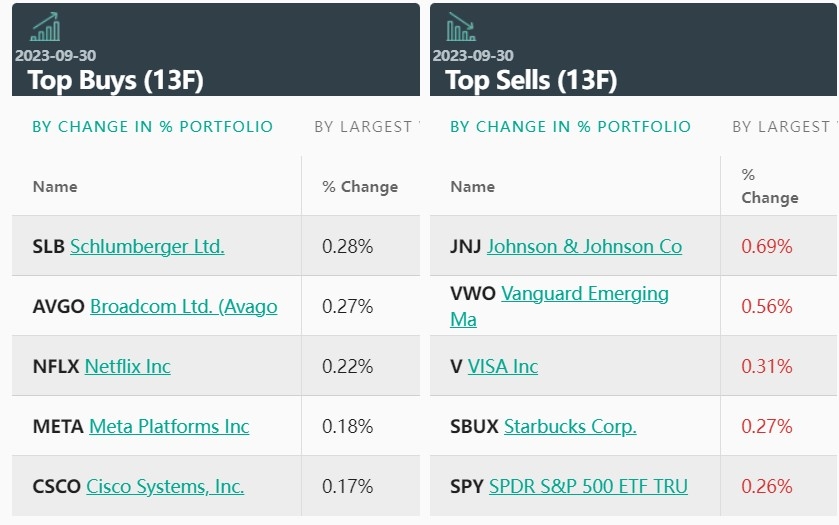

- Volume: The volume of a stock reflects the number of shares traded over a specific period. High volume often indicates significant interest in the stock, while low volume may suggest a lack of interest.

- Indicators: Technical indicators, such as moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence), can provide additional insights into the stock's potential direction.

Case Study: Apple Inc. (AAPL)

Let's take a look at Apple Inc. (AAPL) as an example. Over the past year, AAPL has shown a strong uptrend, with higher highs and higher lows. The stock has also seen significant volume, indicating strong interest from investors. By analyzing the chart, we can see that AAPL has repeatedly tested a support level at $130, which has held firm. This suggests that the stock may continue to rise in the near future.

Conclusion

Stock charts are a vital tool for investors looking to make informed decisions. By understanding the different types of charts, reading them effectively, and analyzing key elements such as trends, support and resistance, and volume, investors can gain valuable insights into the stock market. Whether you're a beginner or an experienced investor, mastering the art of stock analysis through charts can help you achieve your investment goals.

"Task Us Stock Price: A Comprehens? new york stock exchange