In the unpredictable world of the stock market, understanding where to invest during a recession is crucial. A recession can bring about uncertainty, but it also presents opportunities for astute investors. This article explores the top 5 US recession stocks that have historically performed well during economic downturns. Get ready to dive into the market with confidence.

1. Technology Stocks: The Future is Always Here

During a recession, technology stocks often remain resilient due to their essential role in daily life. Companies like Apple and Microsoft have shown remarkable stability, even in tough economic times. Their diversified product lines and strong global presence make them excellent choices for recession-proof investments.

Case Study: When the 2008 financial crisis hit, Apple's stock took a dip but recovered quickly, posting a 35% gain in the following year.

2. Healthcare Stocks: Essential Services in Any Economy

Healthcare is a sector that remains relatively stable during recessions. Stocks in companies that provide essential services, such as Johnson & Johnson and Merck, are often considered safe bets. These companies have strong fundamentals and a loyal customer base, making them ideal for long-term investments.

Case Study: During the 2008 recession, Johnson & Johnson's stock experienced a minor dip but recovered and posted a 23% gain over the next two years.

3. Utility Stocks: The Constant Need for Power

Utility companies, such as Exelon and Duke Energy, provide essential services that are not affected by economic downturns. These stocks tend to perform well during recessions, as they offer stable dividends and consistent cash flows.

Case Study: In the 2008 recession, Duke Energy's stock remained relatively flat, and its dividend yield increased, making it an attractive investment for income seekers.

4. Consumer Goods Stocks: Essential Products in Every Home

Consumer goods companies, like Procter & Gamble and Coca-Cola, produce products that are always in demand, regardless of the economy. These companies have strong brands and diversified product lines, making them reliable investments during tough times.

Case Study: During the 2008 recession, Procter & Gamble's stock took a minor hit but recovered quickly, posting a 17% gain in the following year.

5. Financial Stocks: Stability in a Volatile Market

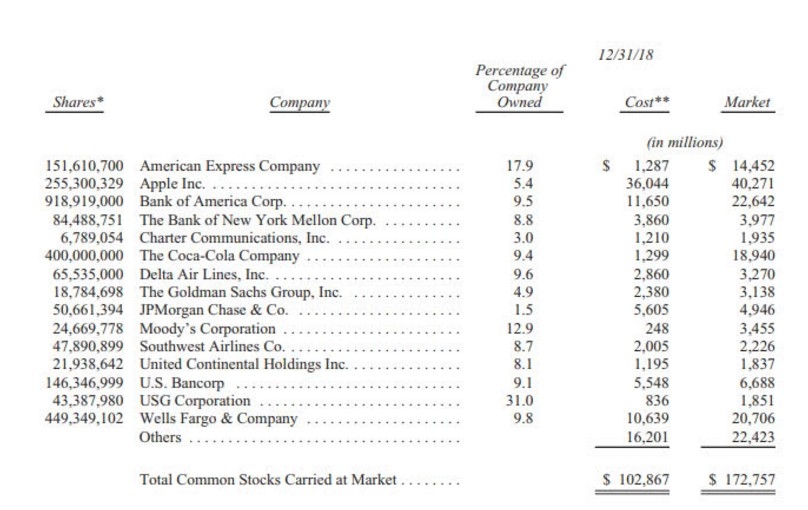

Financial stocks, such as JPMorgan Chase and Wells Fargo, can be a good investment during a recession. These companies often have strong balance sheets and are well-positioned to weather the storm.

Case Study: When the 2008 recession hit, JPMorgan Chase's stock took a significant dip but recovered quickly, posting a 45% gain in the following year.

In conclusion, investing in US recession stocks can be a smart move during economic downturns. By focusing on sectors like technology, healthcare, utilities, consumer goods, and financials, investors can find stability and potentially reap significant returns. Remember, the key to success is thorough research and diversification. Happy investing!

Stock Split Announced in US: What You Need ? new york stock exchange