Are you intrigued by the potential of OBE US stock? Look no further! In this article, we delve into what OBE US stock represents, its market performance, and the factors that make it an attractive investment option. Whether you're a seasoned investor or just starting out, understanding the nuances of OBE US stock is crucial for making informed decisions.

What is OBE US Stock?

OBE US stock refers to the shares of a publicly traded company listed on a U.S. stock exchange. These shares are available for purchase by individual investors, allowing them to become partial owners of the company. The term "OBE" typically stands for "Overseas Business Enterprises" or "Other Business Entities," indicating the nature of the company's operations.

Market Performance of OBE US Stock

The performance of OBE US stock is influenced by various factors, including the company's financial health, industry trends, and overall market conditions. To get a better understanding of its market performance, let's take a look at some key metrics:

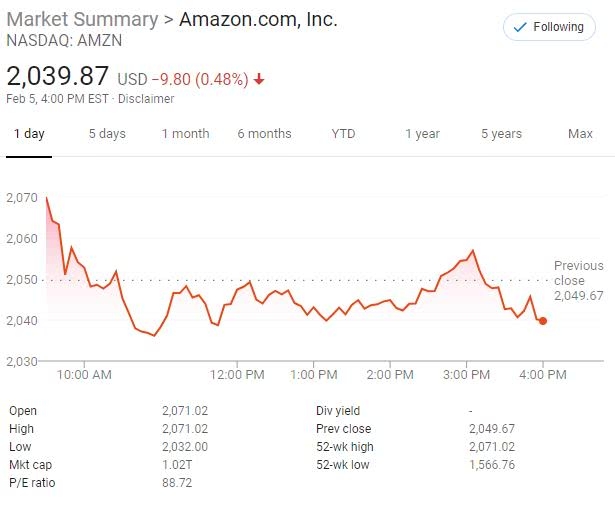

- Stock Price: The stock price of OBE US is determined by supply and demand dynamics in the market. Investors often analyze historical price charts and technical indicators to predict future price movements.

- Dividend Yield: OBE US stock may offer dividends to shareholders, providing an additional source of income. The dividend yield is calculated by dividing the annual dividend per share by the stock's current price.

- Earnings Per Share (EPS): EPS measures the company's profitability and is calculated by dividing the net income by the number of outstanding shares. A higher EPS generally indicates better financial performance.

Factors Influencing OBE US Stock

Several factors can impact the value of OBE US stock:

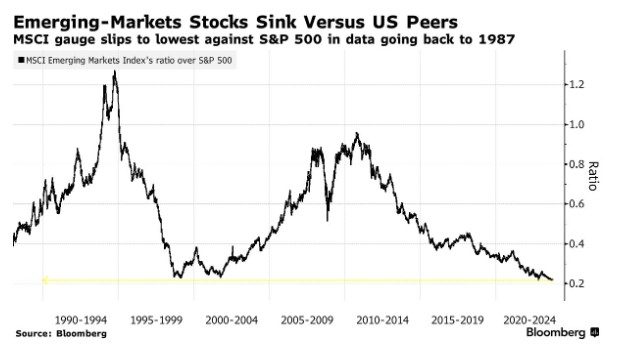

- Economic Conditions: Economic factors such as interest rates, inflation, and GDP growth can affect the stock's performance.

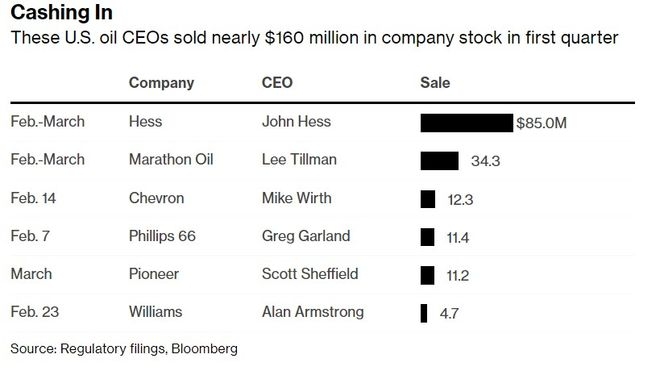

- Company Performance: The company's revenue, profit margins, and growth prospects play a significant role in determining its stock price.

- Industry Trends: Changes in the industry, such as technological advancements or regulatory changes, can impact the company's performance and, subsequently, its stock price.

- Political and Geopolitical Factors: Global events and political instability can also influence the stock's performance.

Case Study: Company X’s OBE US Stock

To illustrate the potential of OBE US stock, let's consider a hypothetical case study of Company X. Company X is a leading player in the technology industry and has been listed on the NASDAQ exchange.

Over the past five years, Company X’s OBE US stock has experienced significant growth, with a compound annual growth rate (CAGR) of 20%. This growth can be attributed to the company’s innovative products, strong financial performance, and a robust market position.

Investing in OBE US Stock

Investing in OBE US stock can be a lucrative opportunity, but it's essential to conduct thorough research and consider the following tips:

- Understand the Company: Familiarize yourself with the company’s business model, products, and market position.

- Analyze Financial Statements: Review the company’s financial statements, including the balance sheet, income statement, and cash flow statement, to assess its financial health.

- Diversify Your Portfolio: Consider investing in a mix of stocks to mitigate risk.

- Stay Informed: Keep up with the latest news and trends in the industry and the broader market.

In conclusion, OBE US stock presents a promising investment opportunity for those looking to capitalize on the growth potential of a publicly traded company. By understanding the factors that influence its performance and conducting thorough research, investors can make informed decisions and potentially achieve significant returns.

Per Stock US, India, Japan: A Comparative A? new york stock exchange