In the fast-paced world of finance, staying updated with market trends is crucial. The Dow Jones, a widely followed stock market index, has seen significant movements over the past month. This article delves into the key developments, offering insights into what these changes mean for investors and traders.

Market Performance Overview

The Dow Jones Industrial Average (DJIA) has experienced a rollercoaster ride over the past month. At the beginning of the month, the index was trading around 33,000 points. However, as the month progressed, it faced several challenges, including rising inflation concerns and geopolitical tensions.

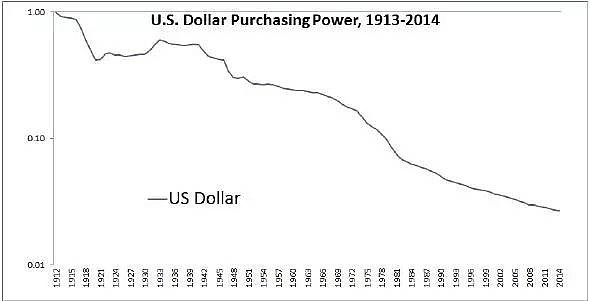

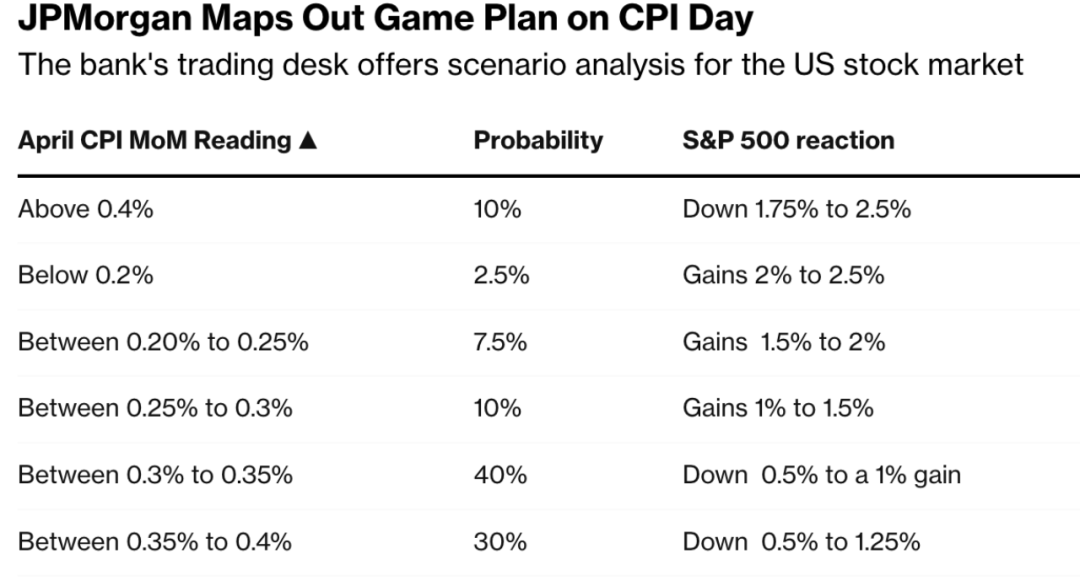

Rising Inflation Concerns

One of the major factors affecting the Dow Jones in the past month has been rising inflation. The Consumer Price Index (CPI) has been on the rise, leading to concerns about the potential for higher interest rates. This has put pressure on the stock market, as investors worry about the impact of higher borrowing costs on corporate earnings.

Geopolitical Tensions

In addition to inflation concerns, geopolitical tensions have also played a role in the Dow Jones' recent performance. Tensions between major economies, such as the United States and China, have raised concerns about global economic stability. These concerns have contributed to market volatility and have impacted the Dow Jones.

Sector Performance

Looking at the sector performance within the Dow Jones, some sectors have outperformed while others have struggled. The technology sector, which includes companies like Apple and Microsoft, has been a major driver of the index's performance. On the other hand, sectors like energy and financials have faced challenges due to rising input costs and regulatory concerns.

Key Developments

Several key developments have influenced the Dow Jones in the past month. Here are some of the highlights:

- Earnings Reports: Many companies within the Dow Jones have released their earnings reports, offering insights into their financial performance. Positive earnings reports have supported the index, while negative reports have added to the market's volatility.

- Central Bank Policy: The Federal Reserve's decision to raise interest rates has been a significant factor in the Dow Jones' recent performance. Investors are closely watching for further rate hikes and their potential impact on the market.

- Corporate Mergers and Acquisitions: Several major mergers and acquisitions have taken place within the Dow Jones, impacting the index's composition and performance.

Case Studies

To illustrate the impact of these developments, let's look at a couple of case studies:

- Apple: As one of the largest companies within the Dow Jones, Apple's performance has had a significant impact on the index. The company's strong earnings report and positive outlook have supported the index, contributing to its overall performance.

- ExxonMobil: The energy sector has faced challenges due to rising input costs and geopolitical tensions. ExxonMobil, a major player in the energy sector, has been impacted by these factors, contributing to the Dow Jones' volatility.

Conclusion

The Dow Jones has experienced a tumultuous past month, with rising inflation concerns and geopolitical tensions playing a significant role. Despite these challenges, the index has shown resilience, supported by strong earnings reports and positive outlooks from major companies. As we move forward, investors will need to closely monitor these factors and their potential impact on the market.

How Did Covid Affect the US Stock Market?? stock chap