The year 2025 is shaping up to be a pivotal moment for the US stock market. As investors prepare for the new year, it's crucial to understand the potential risks that could impact their portfolios. This article delves into the key risks facing the US stock market in 2025, providing insights to help investors navigate the choppy waters ahead.

Economic Uncertainties

One of the most significant risks to the US stock market in 2025 is economic uncertainty. The global economy is still recovering from the COVID-19 pandemic, and there are several factors that could create volatility in the markets:

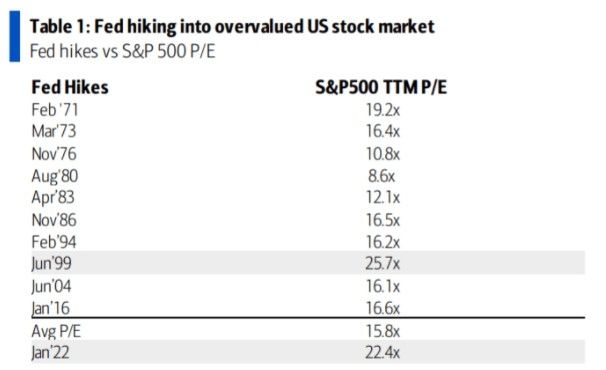

- Inflation: The Federal Reserve has been raising interest rates to combat high inflation, which could slow economic growth and lead to a recession.

- Geopolitical Tensions: Escalating tensions in regions like Eastern Europe and the Middle East could disrupt global trade and affect corporate earnings.

- Supply Chain Disruptions: The ongoing supply chain issues could lead to higher costs for businesses, potentially impacting their profitability and stock prices.

Technological Disruptions

Technology is a driving force behind much of the stock market's growth, but it also poses significant risks:

- Cybersecurity Threats: The increasing number of cyber attacks could disrupt business operations and lead to significant financial losses.

- Regulatory Changes: Governments around the world are stepping up their efforts to regulate tech companies, which could impact their profitability and market value.

- Innovation Competition: The rapid pace of technological innovation means that companies must constantly invest in research and development to stay ahead of the competition, which could strain their financial resources.

Sector-Specific Risks

Certain sectors of the stock market are more susceptible to specific risks in 2025:

- Energy Sector: The global energy landscape is changing rapidly, with a shift towards renewable energy sources. This could impact the profitability of traditional energy companies.

- Healthcare Sector: The ongoing COVID-19 pandemic has highlighted the importance of the healthcare sector, but there are concerns about rising healthcare costs and the potential for policy changes.

- Consumer Discretionary Sector: The consumer discretionary sector is sensitive to economic conditions and consumer confidence, which could be affected by inflation and rising interest rates.

Case Studies

To illustrate the potential risks, consider the following case studies:

- Tesla: As a leader in the electric vehicle market, Tesla has seen significant growth, but the company's reliance on lithium-ion batteries could be impacted by supply chain disruptions and environmental concerns.

- Meta Platforms (formerly Facebook): Meta has faced increased regulatory scrutiny over its data practices, which could affect its advertising revenue and market value.

- Walmart: Walmart has been able to navigate economic downturns in the past, but the company faces challenges from online competitors and rising transportation costs.

Conclusion

Navigating the risks in the 2025 US stock market requires a keen understanding of the economic, technological, and sector-specific challenges that lie ahead. By staying informed and prepared, investors can position themselves to weather the storm and potentially capitalize on opportunities that arise.

Best US Penny Stocks to Buy Right Now: Top ? us flag stock