In early 2023, the United States credit rating was downgraded for the first time in nearly a decade. This significant event has sent shockwaves through the stock market, raising concerns and prompting investors to reassess their strategies. This article delves into the reasons behind the downgrade, the immediate stock market reaction, and the long-term implications for investors.

Reasons for the Credit Rating Downgrade

The downgrade of the US credit rating was primarily due to concerns over the country's rising national debt and budget deficit. The rating agencies, including Moody's and Fitch, cited the lack of a clear plan to reduce the debt as a key factor in their decision. Additionally, the political gridlock in Washington, DC, has made it difficult to pass meaningful fiscal reforms.

Immediate Stock Market Reaction

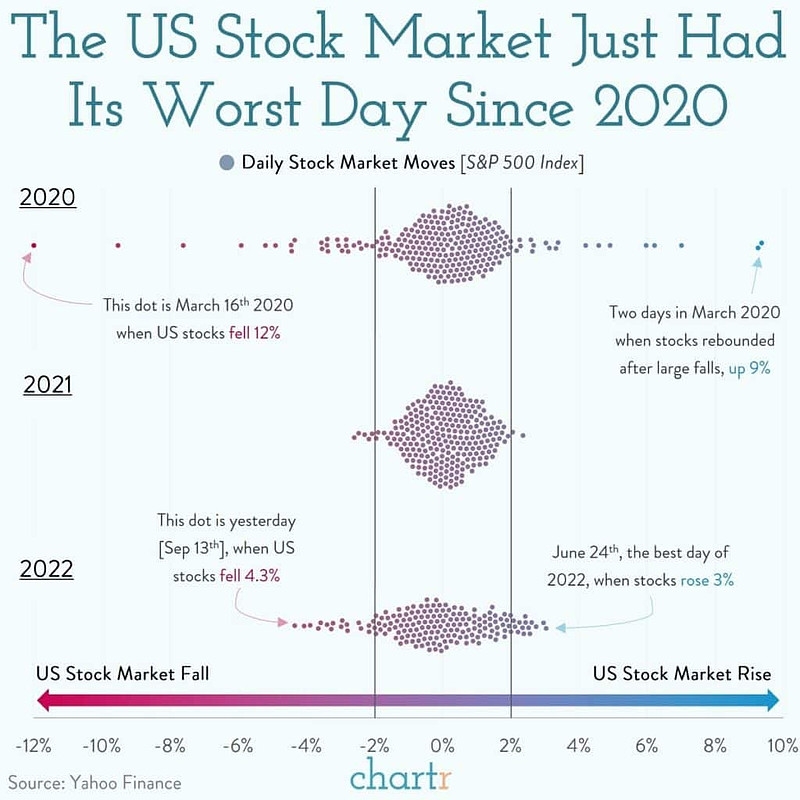

The stock market's reaction to the credit rating downgrade was swift and negative. The Dow Jones Industrial Average and the S&P 500 fell sharply in the days following the announcement. Many investors were caught off guard by the downgrade and sought to protect their portfolios by selling off stocks.

Long-Term Implications

While the immediate stock market reaction was negative, the long-term implications of the credit rating downgrade are less clear. Some experts believe that the downgrade will lead to higher borrowing costs for the government and consumers, which could slow economic growth. Others argue that the downgrade is a wake-up call for policymakers to address the country's fiscal challenges.

Case Studies

One notable case study is the 2011 downgrade of the US credit rating by Standard & Poor's. This downgrade led to a brief but sharp sell-off in the stock market, with the S&P 500 falling by nearly 7% in a single day. However, the market quickly recovered, and the S&P 500 ended the year with a gain of nearly 12%.

Another example is the downgrade of Japan's credit rating in 2012. Despite the downgrade, the Japanese stock market actually rallied in the following months, driven by expectations of further monetary stimulus from the Bank of Japan.

Conclusion

The 2023 US credit rating downgrade has sent shockwaves through the stock market, raising concerns and prompting investors to reassess their strategies. While the immediate reaction was negative, the long-term implications are less clear. Investors must stay vigilant and be prepared to adapt to changing market conditions.

Stock Split and Bonus Candidates in the US:? us stock market live