In the ever-evolving landscape of the stock market, identifying fundamentally strong US stocks is crucial for investors seeking long-term growth and stability. These stocks often outperform their peers and provide a solid foundation for a diversified portfolio. This article delves into the characteristics of fundamentally strong US stocks and offers insights into how investors can identify and capitalize on these investment opportunities.

Understanding Fundamental Analysis

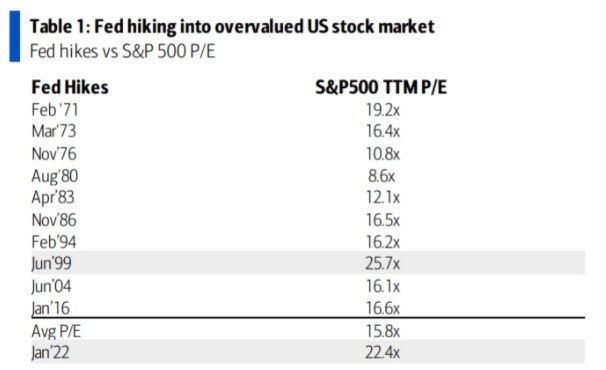

Fundamental analysis is a method used to evaluate the intrinsic value of a company by examining its financial statements, business model, and industry position. Unlike technical analysis, which focuses on price movements and trading patterns, fundamental analysis looks at the underlying factors that drive a company's performance. Key metrics used in fundamental analysis include earnings per share (EPS), price-to-earnings (P/E) ratio, return on equity (ROE), and debt-to-equity ratio.

Characteristics of Fundamentally Strong US Stocks

Strong Financial Performance: Companies with consistently high revenue growth, strong profit margins, and positive cash flow are typically considered fundamentally strong. These companies demonstrate their ability to generate sustainable profits and create value for shareholders.

Robust Business Model: A fundamentally strong stock often belongs to a company with a durable and scalable business model. This could be a company with a strong brand, a unique product or service, or a competitive advantage in its industry.

Competitive Position: Companies that hold a dominant market position or have a strong competitive advantage are more likely to be fundamentally strong. This could be due to factors such as a strong network effect, high barriers to entry, or proprietary technology.

Quality Management: A company with a competent and experienced management team is more likely to be fundamentally strong. These leaders are responsible for making strategic decisions, managing risks, and driving growth.

Dividend Payout: Companies that consistently pay dividends are often considered fundamentally strong. Dividends provide a steady income stream for investors and indicate that the company has sufficient cash flow to reward shareholders.

Identifying Fundamentally Strong US Stocks

Research and Due Diligence: Conduct thorough research on potential investments, including analyzing financial statements, reading annual reports, and understanding the company's business model and industry position.

Use of Financial Metrics: Utilize financial metrics such as EPS, P/E ratio, ROE, and debt-to-equity ratio to assess the financial health and performance of a company.

Consulting Analyst Reports: Analyst reports can provide valuable insights into a company's fundamentals and potential investment opportunities.

Diversification: Diversify your portfolio by investing in fundamentally strong stocks across various industries and sectors to mitigate risk.

Case Studies

Apple Inc. (AAPL): Apple is a prime example of a fundamentally strong US stock. The company has a strong brand, a durable business model, and a competitive advantage in the technology industry. Apple has consistently delivered strong financial performance and has a long history of paying dividends.

Microsoft Corporation (MSFT): Microsoft is another fundamentally strong US stock with a strong brand, a durable business model, and a competitive advantage in the technology industry. The company has a diverse product portfolio and has consistently delivered strong financial performance.

In conclusion, identifying fundamentally strong US stocks requires thorough research, analysis, and a clear understanding of the company's financial health and competitive position. By focusing on companies with strong financial performance, a robust business model, and a competitive advantage, investors can build a diversified portfolio that is well-positioned for long-term growth and stability.

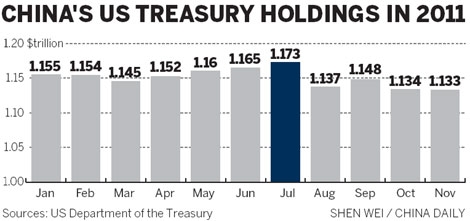

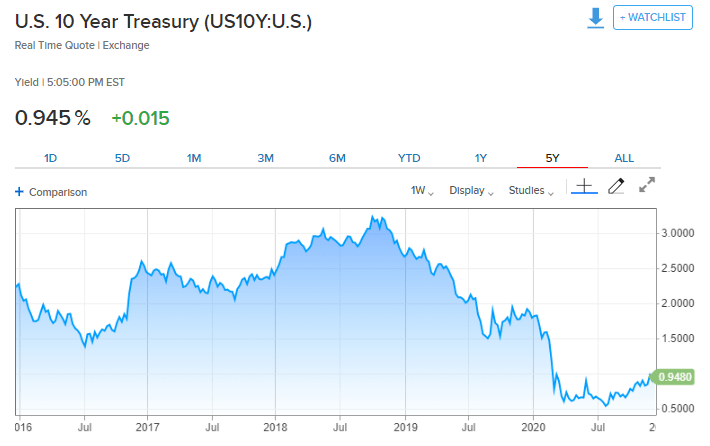

Historical Data Yahoo: Unveiling the Power ? us stock market live