Are you contemplating investing in US stocks but unsure whether now is the right time? The stock market is a complex and dynamic landscape, and making informed decisions is crucial. This article delves into the factors you should consider to determine if the current market conditions are favorable for purchasing US stocks.

Market Trends and Economic Indicators

One of the first things to consider when evaluating whether it's a good time to buy US stocks is the current market trends and economic indicators. Here are some key factors to keep in mind:

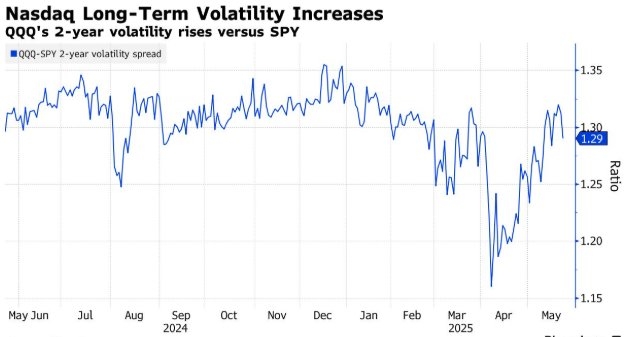

- Stock Market Indices: Track the major stock market indices like the S&P 500, the Dow Jones Industrial Average, and the NASDAQ Composite. These indices can provide a snapshot of the overall market sentiment and performance.

- Economic Growth: Monitor economic indicators such as GDP growth, unemployment rates, and inflation. Strong economic growth and low unemployment rates can signal a positive market environment.

- Interest Rates: Interest rates play a significant role in the stock market. Lower interest rates can make stocks more attractive, while higher rates can negatively impact stock prices.

Sector Analysis

Another crucial aspect to consider is the performance of different sectors within the US stock market. Some sectors may be performing well, while others may be facing challenges. Here's a breakdown of key sectors:

- Technology: The technology sector has been a major driver of stock market growth over the past few years. Companies like Apple, Microsoft, and Amazon have seen significant growth, but it's important to assess the current market conditions and valuation levels before investing.

- Healthcare: The healthcare sector is often considered a defensive play, as demand for healthcare services tends to remain stable regardless of market conditions. However, regulatory changes and competition can impact sector performance.

- Energy: The energy sector can be volatile, but it has seen a resurgence in recent years due to advancements in technology and increased demand for renewable energy sources.

Company Fundamentals

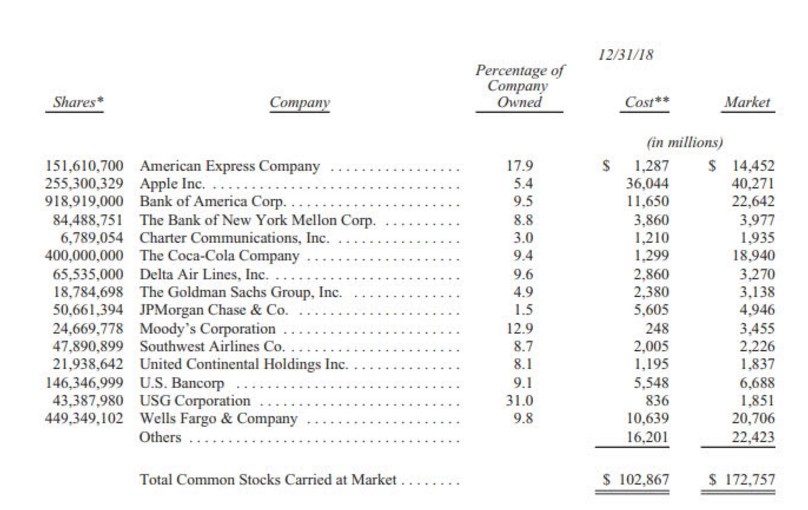

Analyzing the fundamentals of individual companies is crucial before making any investment decisions. Here are some key metrics to consider:

- Earnings: Look for companies with strong earnings growth and a solid track record of profitability.

- Dividends: Companies with a history of paying dividends can provide a steady stream of income for investors.

- Valuation: Assess the valuation of a company by looking at metrics like price-to-earnings (P/E) ratio and price-to-book (P/B) ratio. Overvalued stocks may be at risk of a pullback, while undervalued stocks could offer a good investment opportunity.

Risk Management

Investing in the stock market always comes with risk, so it's important to have a well-defined risk management strategy. Here are some tips:

- Diversify Your Portfolio: Don't put all your eggs in one basket. Diversify your investments across different sectors, industries, and asset classes to reduce risk.

- Set Stop-Loss Orders: Use stop-loss orders to limit potential losses on your investments.

- Stay Informed: Keep up with market news and company updates to stay informed about potential risks and opportunities.

Case Studies

To illustrate the importance of analyzing market conditions and company fundamentals, let's look at a few case studies:

- Tesla (TSLA): Tesla has seen significant growth in recent years, driven by strong earnings and innovation. However, the stock's valuation has been a point of contention among investors.

- Amazon (AMZN): Amazon has been a leader in the technology sector, but its valuation has also been a concern. Investors should consider the company's long-term growth prospects and the potential risks associated with its high valuation.

- Johnson & Johnson (JNJ): Johnson & Johnson is a well-established healthcare company with a strong track record of earnings growth and dividends. Investors should assess the company's exposure to regulatory risks and competition in the healthcare industry.

Conclusion

Determining whether it's a good time to buy US stocks requires careful analysis of market trends, economic indicators, sector performance, and company fundamentals. By staying informed and applying sound risk management strategies, investors can make more informed decisions and potentially achieve long-term success in the stock market.

Does Japan Nintendo Stock Affect US Nintend? us stock market live