In the world of investing, understanding stock quotations is crucial for making informed decisions. Whether you're a seasoned investor or just starting out, knowing how to interpret stock quotes can significantly impact your investment strategy. This article delves into the basics of stock quotations, providing you with a comprehensive guide to help you navigate the stock market with confidence.

What Are Stock Quotations?

Stock quotations represent the current price of a stock, which is constantly fluctuating based on market demand and supply. These quotes provide essential information about a stock's performance and its potential for investment. Typically, a stock quotation includes the following elements:

- Stock Symbol: This is a unique identifier for a particular stock, such as AAPL for Apple Inc.

- Bid Price: The highest price a buyer is willing to pay for the stock.

- Ask Price: The lowest price a seller is willing to accept for the stock.

- Last Price: The most recent price at which a trade was executed.

- Day's High/Low: The highest and lowest prices the stock has reached during the trading day.

Understanding Stock Quotes

To make sense of stock quotations, it's essential to understand the following concepts:

- Market Capitalization: This is the total value of a company's outstanding shares. It's calculated by multiplying the stock price by the number of shares outstanding.

- Dividend Yield: This is the percentage return on an investment based on the company's annual dividend payments. It's calculated by dividing the annual dividend per share by the stock's current price.

- Price-to-Earnings (P/E) Ratio: This ratio compares the stock's price to its earnings per share (EPS). It helps investors assess whether a stock is overvalued or undervalued.

How to Use Stock Quotes for Investment Decisions

By analyzing stock quotations, investors can make informed decisions about buying, selling, or holding stocks. Here are some tips for using stock quotes effectively:

- Compare Stock Quotes: Compare the bid and ask prices to determine if a stock is overvalued or undervalued. If the bid price is significantly lower than the ask price, it may indicate a lack of interest in the stock.

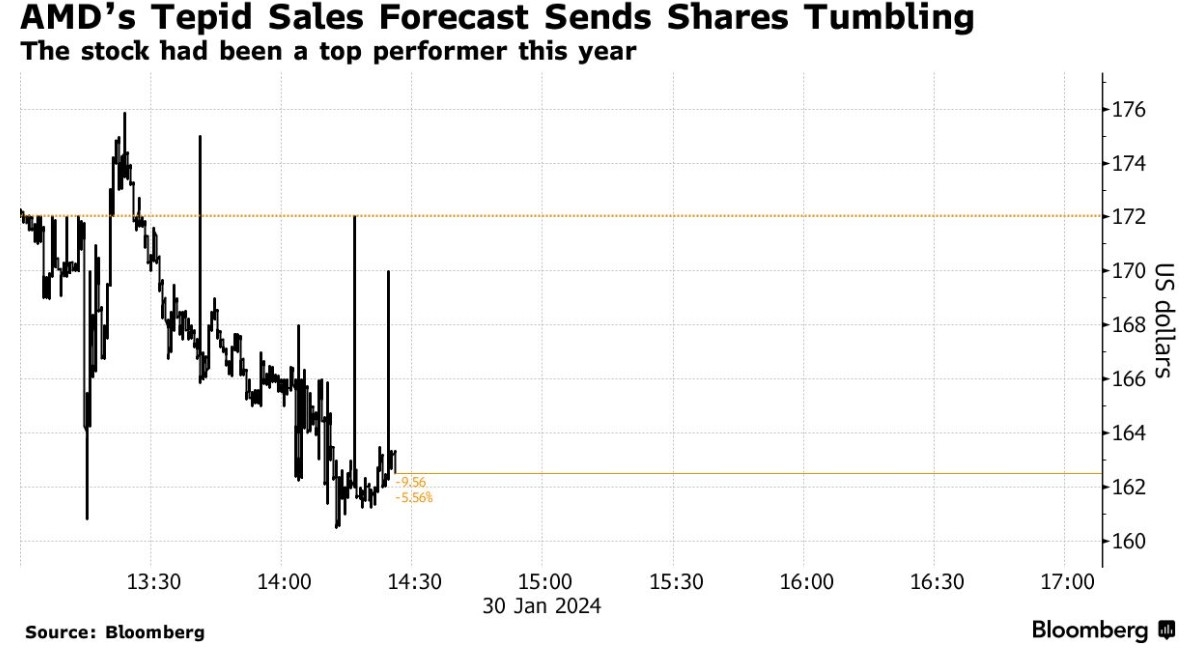

- Monitor Market Trends: Keep an eye on the day's high and low prices to gauge market sentiment. If a stock is trading near its day's high, it may be a good buy. Conversely, if it's trading near its day's low, it may be a good sell.

- Analyze Financial Ratios: Use financial ratios like P/E and dividend yield to assess a stock's value and potential for investment.

Case Study: Apple Inc. (AAPL)

Let's take a look at Apple Inc. (AAPL) as an example. As of the latest stock quotation, AAPL has a bid price of

Based on this information, an investor might decide to buy AAPL if they believe the stock is undervalued or if they're looking for a long-term investment with a stable dividend yield.

Conclusion

Understanding stock quotations is essential for making informed investment decisions. By analyzing the bid, ask, and last prices, as well as other key metrics, investors can gain valuable insights into a stock's performance and potential. Keep in mind that stock quotations are just one piece of the puzzle, and it's important to conduct thorough research before making any investment decisions.

Unveiling the US Stock Calendar: A Comprehe? us stock market live