In today's fast-paced financial world, stock charts have become an essential tool for investors and traders alike. These visual representations of stock price movements can provide valuable insights into market trends and potential investment opportunities. But with so many different types of stock charts available, it can be overwhelming to know where to start. In this article, we'll explore the basics of stock charts, their importance in the public domain, and how you can use them to make informed investment decisions.

What Are Stock Charts?

Stock charts are graphical representations of stock prices over a specific period of time. They can display various types of data, including opening and closing prices, high and low prices, and trading volume. There are several different types of stock charts, each with its own unique features and uses.

The Importance of Public Stock Charts

Public stock charts are freely available to anyone interested in the stock market. This accessibility makes them an invaluable resource for investors and traders of all levels. Here are a few reasons why public stock charts are so important:

Educational Tool: For beginners, public stock charts can be a great educational tool to understand how the stock market works and how to interpret different types of chart patterns.

Market Analysis: Traders use public stock charts to analyze market trends and identify potential trading opportunities. By studying past price movements, traders can make more informed decisions about when to buy or sell stocks.

Investment Decisions: Investors can use public stock charts to assess the performance of their investments and make adjustments to their portfolios based on market trends.

Types of Stock Charts

There are several types of stock charts available, each with its own advantages and disadvantages. Here are the most common types:

Line Charts: The simplest type of stock chart, line charts only display the opening and closing prices of a stock over a specific period of time. They are useful for getting a quick overview of price movements.

Bar Charts: Bar charts provide more information than line charts, including opening and closing prices, high and low prices, and trading volume. They are more useful for analyzing short-term price movements.

Candlestick Charts: Similar to bar charts, candlestick charts use a series of vertical "candles" to represent price movements. The color of the candle can indicate whether the stock closed higher or lower than the opening price.

Point and Figure Charts: Point and figure charts are unique in that they do not display time. Instead, they use X's and O's to represent price movements. They are useful for identifying long-term trends.

Using Stock Charts for Investment Decisions

To effectively use stock charts for investment decisions, it's important to understand how to interpret different chart patterns. Here are a few key patterns to look out for:

Support and Resistance: These are levels where the stock has repeatedly failed to move below (support) or above (resistance). They can be used to identify potential entry and exit points.

Trend Lines: These are lines drawn through a series of price points to identify the direction of the market. Uptrend lines are drawn upward, while downtrend lines are drawn downward.

Chart Patterns: There are many different chart patterns, such as head and shoulders, triangles, and flags. These patterns can indicate potential reversals or continuations in the market.

Case Study: Apple Inc. (AAPL)

To illustrate how stock charts can be used, let's take a look at Apple Inc. (AAPL). In the following candlestick chart, we can see that the stock has been in an uptrend for the past few months. The chart shows several instances of support and resistance, as well as a head and shoulders pattern that could indicate a potential reversal.

By understanding these chart patterns and using them to analyze the stock, investors can make more informed decisions about when to buy or sell Apple stock.

In conclusion, stock charts are a powerful tool for anyone interested in the stock market. By understanding the different types of stock charts and how to interpret them, you can make more informed investment decisions and potentially improve your returns. So next time you're looking at the stock market, remember to take a closer look at the charts – they might just hold the key to your success.

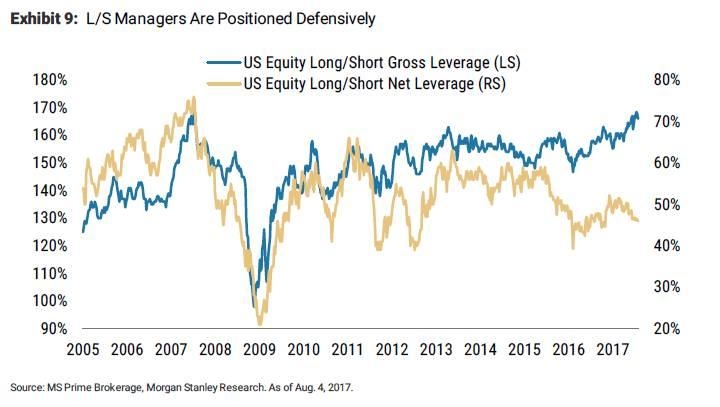

Max Leverage US Stocks: Strategies for Ampl? us stock market live