In the ever-evolving cannabis industry, investors are increasingly seeking opportunities to tap into this burgeoning market. One of the most popular ways to gain exposure to marijuana-related companies is through an ETF (Exchange Traded Fund). In this article, we will delve into the details of US marijuana stocks ETFs, highlighting their benefits, potential risks, and top-performing funds.

Understanding US Marijuana Stocks ETFs

US marijuana stocks ETFs are investment funds that track the performance of a basket of marijuana-related companies. These funds offer investors a way to gain diversified exposure to the cannabis industry without having to individually research and invest in each company. This can be particularly appealing for investors who want to allocate a portion of their portfolio to the marijuana sector but lack the time or expertise to do so.

Benefits of Investing in US Marijuana Stocks ETFs

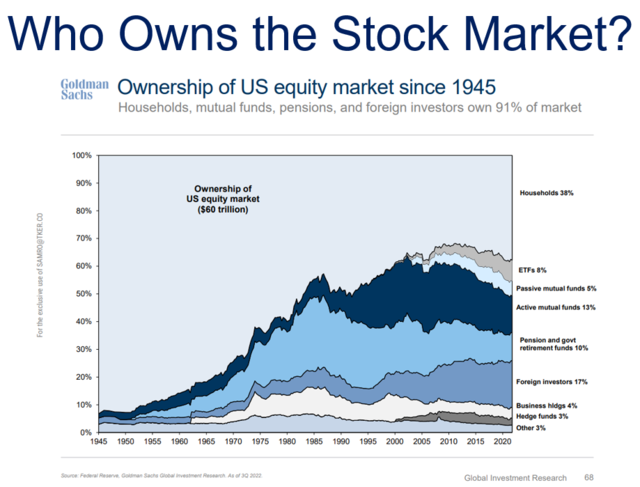

- Diversification: ETFs provide exposure to a wide range of companies within the cannabis industry, reducing the risk associated with investing in a single company.

- Ease of Access: Investing in an ETF is straightforward and can be done through most brokerage accounts.

- Lower Fees: ETFs often have lower fees compared to mutual funds, making them a cost-effective investment option.

- Tax Efficiency: ETFs are taxed like a stock, which can be more tax-efficient than mutual funds.

Top US Marijuana Stocks ETFs to Consider

Horizons Marijuana Life Sciences ETF (HMMJ) – This ETF tracks the North American Medical Marijuana Index and is one of the most popular marijuana ETFs available in the United States. It includes companies involved in the production, distribution, and research of medical cannabis.

Cannabis ETF (NYSEARCA: CANNA) – This ETF provides exposure to a diverse portfolio of companies involved in the cannabis industry, including growers, distributors, and ancillary businesses.

Global X Marijuana ETF (NYSEARCA: MJ) – This ETF offers exposure to a global portfolio of companies involved in the cannabis industry, including both North American and international companies.

Potential Risks

While investing in US marijuana stocks ETFs can be an attractive opportunity, it's important to be aware of the potential risks:

- Regulatory Risks: The cannabis industry is highly regulated, and changes in regulations can significantly impact the performance of companies within the sector.

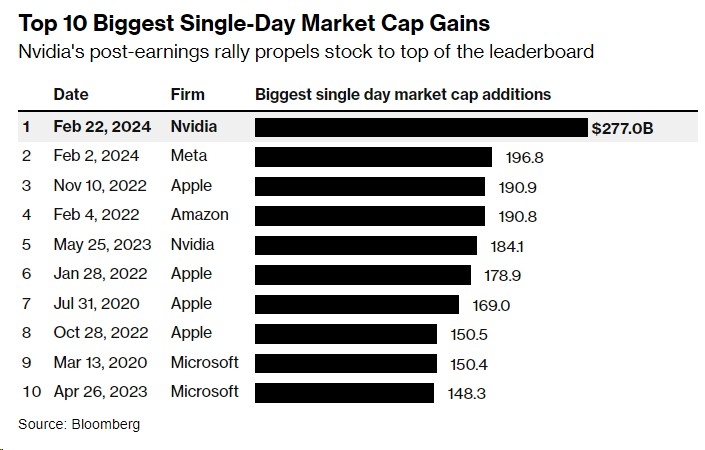

- Market Volatility: The cannabis industry is still in its early stages, and as such, it is subject to high levels of market volatility.

Case Study: Tilray Inc.

One notable company within the marijuana sector is Tilray Inc. (NASDAQ: TLRY), which is included in several marijuana ETFs. Tilray is a global leader in cannabis research, cultivation, and distribution. While Tilray has seen significant growth, it has also faced challenges, such as regulatory hurdles and market competition.

By investing in a marijuana stocks ETF that includes Tilray, investors can gain exposure to the company's growth potential while mitigating some of the risks associated with investing in individual stocks.

In conclusion, US marijuana stocks ETFs provide investors with a convenient and cost-effective way to gain exposure to the cannabis industry. While there are potential risks, the benefits of diversification and lower fees make them an attractive option for investors looking to invest in this emerging market.

"Tgif Us Stock: Exploring the Impa? us stock market live