The 2020 US Presidential Election was a defining moment for the nation, and its impact rippled through various sectors, including the stock market. This article delves into how the stock market reacted during and after the election, offering insights into the potential correlations between political events and market trends.

The Pre-Election Tensions

In the lead-up to the election, the stock market experienced a rollercoaster ride. Concerns about the outcome, the potential for political gridlock, and the ongoing COVID-19 pandemic added to the uncertainty. Many investors were on edge, with the S&P 500 index fluctuating significantly in the weeks preceding the election.

The Election Night Surge

When the results were finally announced, the stock market responded positively. The S&P 500 index surged by nearly 3% in the first trading session after the election, marking one of its best gains in years. This surge was attributed to a few key factors:

- Relief from Uncertainty: The market had been waiting with bated breath for the election results, and the final outcome brought an end to the uncertainty.

- Potential for Policy Stability: Investors were optimistic about the possibility of policy stability under the new administration, which could lead to more predictable market conditions.

- Economic Stimulus Expectations: The incoming administration's plans for economic stimulus were seen as a positive sign for the market.

Sector-Specific Impacts

The election also had a significant impact on various sectors of the stock market. For instance:

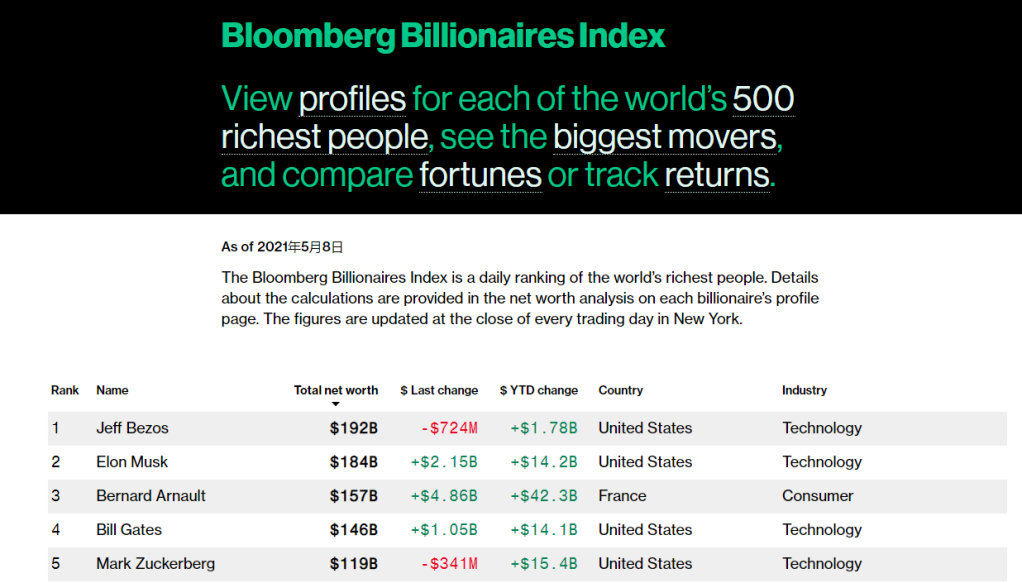

- Technology Stocks: Tech stocks, which had been under pressure leading up to the election, saw a surge in the aftermath. This was attributed to the expectation that the new administration would prioritize tech innovation and support.

- Healthcare Stocks: Healthcare stocks also experienced a boost, as investors anticipated increased spending on healthcare under the new administration.

- Financial Stocks: Financial stocks, on the other hand, saw a slight decline, as investors were concerned about potential changes to financial regulations.

Case Studies

To better understand the impact of the election on the stock market, let's look at a few case studies:

- Amazon: After the election, Amazon's stock surged by over 6%, driven by expectations of increased tech innovation and support from the new administration.

- Moderna: The biotech company's stock saw a significant boost, as investors anticipated increased spending on healthcare under the new administration.

- Goldman Sachs: The financial services giant's stock saw a slight decline, as investors were concerned about potential changes to financial regulations.

Conclusion

The 2020 US Presidential Election had a significant impact on the stock market, with investors reacting positively to the outcome. While the election brought an end to uncertainty, it also highlighted the potential for policy changes that could affect various sectors of the market. As the market continues to evolve, investors will need to stay vigilant and adapt to the changing political landscape.

Historical US Government Shutdown: A Deep D? us stock market live