In the dynamic world of the stock market, keeping a close eye on the performance of major companies is crucial for investors. One such company that has always been under the scanner is US Steel. This article delves into the latest trends, insights, and analysis of US Steel's stock market performance.

Understanding US Steel's Stock Market Performance

US Steel Corporation, one of the largest steel producers in the world, has a significant presence in the stock market. Its stock performance is often a reflection of the overall health of the steel industry and the global economy. In this section, we will discuss the key factors that influence US Steel's stock market performance.

Economic Indicators and Market Trends

The performance of US Steel's stock is closely tied to economic indicators and market trends. For instance, during periods of economic growth, demand for steel increases, leading to higher profits for steel companies. Conversely, during economic downturns, demand for steel falls, affecting the profitability of these companies.

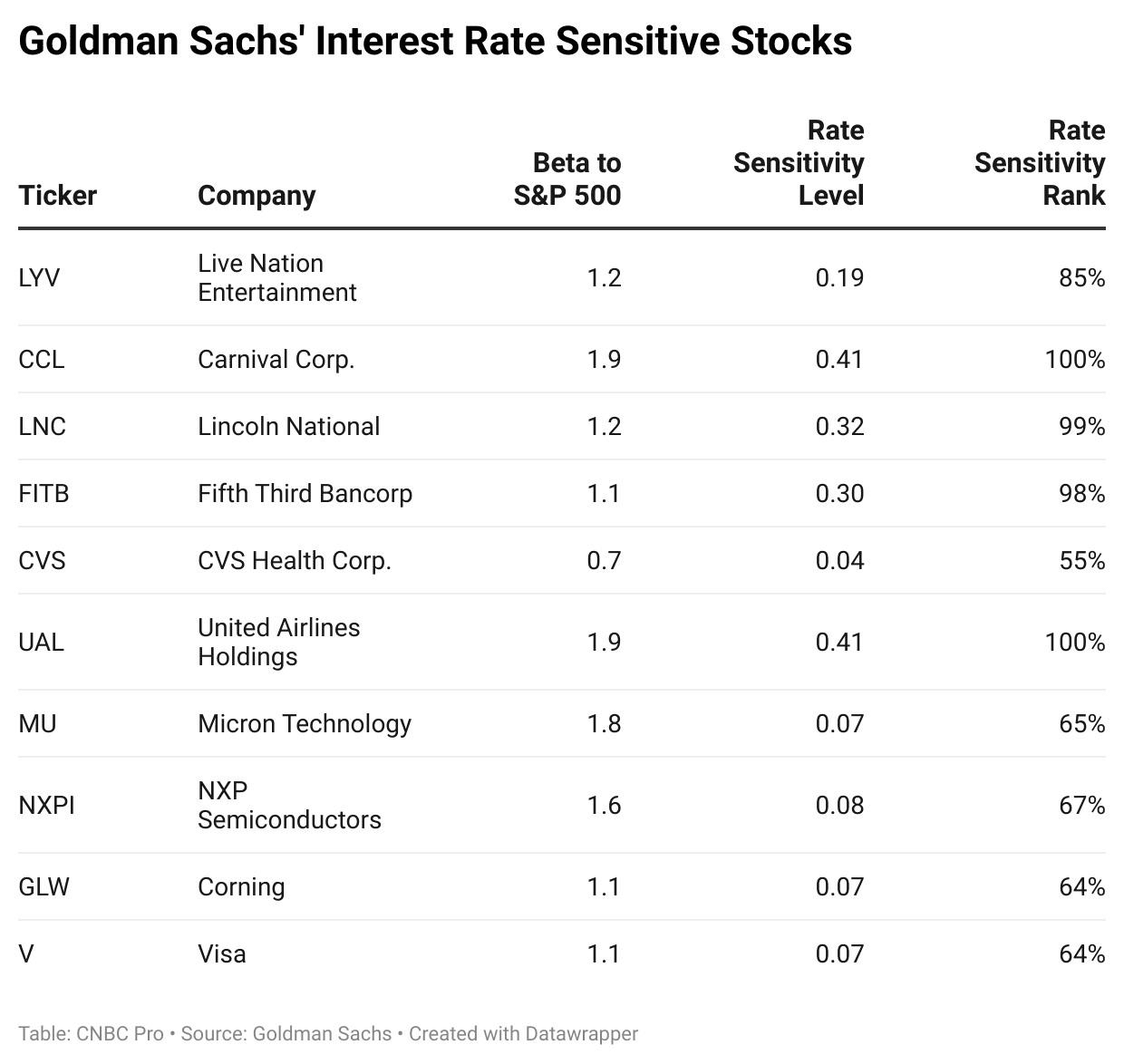

One such indicator that has a significant impact on US Steel's stock is the Consumer Price Index (CPI). An increase in the CPI often leads to higher steel prices, boosting the company's earnings. Similarly, changes in interest rates and currency exchange rates can also affect the stock's performance.

Industry Analysis

The steel industry is highly competitive, with numerous players vying for market share. US Steel's position in the industry is influenced by various factors, including its production capacity, cost structure, and innovation capabilities.

One key factor that has impacted US Steel's stock is the company's ability to adapt to changing market conditions. For instance, the company has made significant investments in technology and automation to improve its production efficiency and reduce costs.

Case Study: US Steel's Response to the Global Financial Crisis

One notable example of US Steel's resilience is its response to the global financial crisis in 2008. Despite the downturn in the economy, the company managed to navigate through the tough times by implementing cost-cutting measures and focusing on high-value products. This strategic approach helped the company to emerge stronger from the crisis, and its stock began to recover.

Dividend Yield and Future Prospects

US Steel has a strong track record of paying dividends to its shareholders. The company's dividend yield has been a key attraction for investors looking for stable income from their investments. Moving forward, the company's future prospects appear promising, given its focus on innovation and expansion into new markets.

Conclusion

In conclusion, keeping a close watch on US Steel's stock market performance is essential for investors looking to gain insights into the steel industry and the global economy. By analyzing economic indicators, industry trends, and the company's strategic moves, investors can make informed decisions about their investments in US Steel.

Apparel Stocks: The Ultimate Guide to US Ma? us stock market live