Investing in the stock market can be both exciting and daunting. One of the key aspects that investors focus on is the main share price. This article delves into what the main share price is, its importance, and how it affects your investment decisions.

What is the Main Share Price?

The main share price refers to the current market price of a single share of a particular company. It is determined by the supply and demand for the shares in the stock market. The price fluctuates throughout the trading day based on various factors, including company performance, market trends, and investor sentiment.

Importance of Main Share Price

Investment Decisions: The main share price is a critical factor in making investment decisions. It helps investors determine whether a stock is overvalued, undervalued, or fairly priced. This analysis is crucial for maximizing returns and minimizing risks.

Market Trends: By observing the main share price trends, investors can gain insights into the overall market sentiment. This information can be valuable for making informed decisions and timing investments.

Valuation Metrics: The main share price is used in various valuation metrics, such as the price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and dividend yield. These metrics help investors assess the value of a stock relative to its fundamentals.

Factors Affecting Main Share Price

Company Performance: The financial performance of a company, including revenue, earnings, and growth prospects, significantly impacts the main share price. Positive news, such as increased profits or revenue growth, can drive the price up, while negative news can lead to a decline.

Market Conditions: The overall market conditions, including economic indicators, interest rates, and geopolitical events, can influence the main share price. For instance, during a recession, the stock market may experience a decline, affecting the prices of individual shares.

Investor Sentiment: The perception and emotions of investors towards a particular stock or the market as a whole can drive the main share price. This sentiment is often influenced by news, rumors, and market trends.

Case Studies

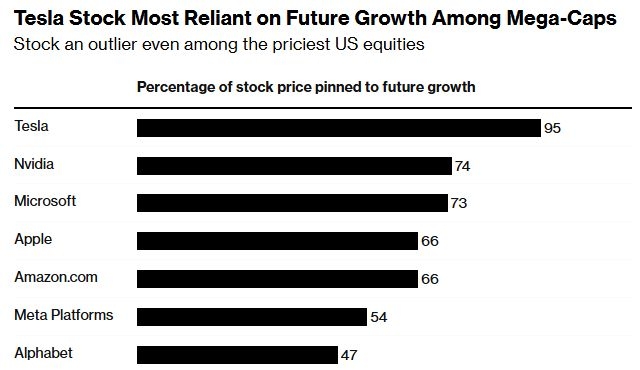

Tesla, Inc.: Tesla's main share price has experienced significant volatility over the years. In 2018, the stock price surged after Tesla announced plans to produce 5 million vehicles annually. However, it faced a decline in 2020 due to concerns about its financial health and competition from other electric vehicle manufacturers.

Amazon.com, Inc.: Amazon's main share price has consistently increased over the years, driven by its strong financial performance and market dominance. The company's continuous expansion into new markets and the launch of innovative products have contributed to its rising share price.

Conclusion

Understanding the main share price is essential for investors looking to make informed decisions in the stock market. By analyzing the factors that influence the price and staying informed about market trends, investors can maximize their returns and minimize risks. Keep in mind that investing in the stock market involves risks, and it's crucial to conduct thorough research and consider seeking professional advice.

Buy Us Stocks from Iraq: A Lucrative Invest? us stock market live