In the fast-paced world of finance, staying ahead of the curve is crucial. One of the most effective tools for investors and traders to gain an edge is the pre-market index. This article delves into what the pre-market index is, how it works, and why it’s a valuable tool for anyone looking to trade stocks before the regular market opens.

What is the Pre-Market Index?

The pre-market index, also known as the pre-market indicator or the pre-market summary, is a gauge of market trends and trading activity that occurs before the regular trading day begins. This index is typically available from around 4:00 AM to 9:30 AM Eastern Standard Time (EST) on trading days.

How Does the Pre-Market Index Work?

The pre-market index is calculated by taking the average of the prices of a select group of stocks that are expected to be actively traded during the upcoming trading day. This group of stocks typically includes the most heavily traded stocks on the major U.S. exchanges, such as the S&P 500, the NASDAQ, and the Dow Jones Industrial Average.

By analyzing the performance of these stocks, investors and traders can gain insights into market sentiment and potential market movements. If the pre-market index is rising, it may indicate that the market is set to open higher. Conversely, a falling pre-market index may suggest a lower opening.

Why is the Pre-Market Index Valuable?

The pre-market index offers several advantages to investors and traders:

- Early Indicators: The pre-market index provides early indicators of market trends and sentiment, allowing investors to make informed decisions before the regular market opens.

- Risk Management: By monitoring the pre-market index, investors can assess the overall market environment and adjust their risk management strategies accordingly.

- Opportunity Identification: The pre-market index can help identify potential opportunities and risks, allowing investors to act quickly on emerging trends.

Case Study: The Impact of the Pre-Market Index on Stock Prices

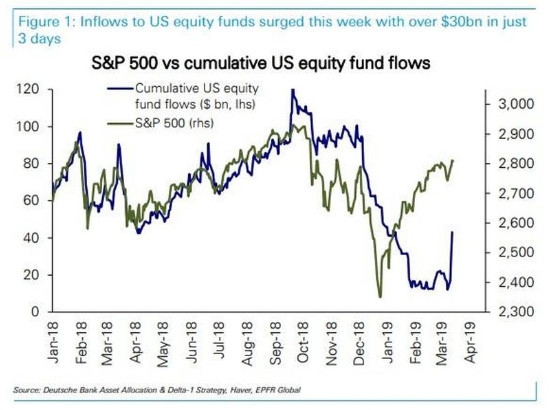

One notable example of the pre-market index’s impact on stock prices occurred in February 2018. On this day, the pre-market index showed a significant drop, indicating a bearish market sentiment. As a result, the stock market opened lower, and many stocks experienced declines. This example highlights how the pre-market index can influence market movements and individual stock prices.

Conclusion

The pre-market index is a powerful tool for investors and traders looking to stay ahead of the curve. By providing early insights into market trends and sentiment, the pre-market index can help investors make informed decisions and manage their risks effectively. Whether you’re a seasoned trader or a beginner investor, understanding the pre-market index is essential for navigating the complex world of finance.

Ammunition Stocks: A Comprehensive Guide fo? us stock market live