Are you a foreigner looking to open a stock account in the US? If so, you've come to the right place. Investing in the US stock market can be a lucrative opportunity, but navigating the process can be daunting. This comprehensive guide will walk you through everything you need to know to open a stock account as a foreigner in the US.

Understanding the Basics

First, let's clarify what a stock account is. A stock account is a brokerage account that allows you to buy and sell stocks, bonds, and other securities. To open a stock account in the US, you'll need to go through a brokerage firm.

Choosing a Brokerage Firm

There are several brokerage firms that cater to foreign investors. Some of the most popular options include TD Ameritrade, E*TRADE, and Charles Schwab. When choosing a brokerage firm, consider factors such as fees, customer service, and available investment options.

Required Documents

To open a stock account in the US, you'll need to provide certain documents. These typically include:

- Passport: Proof of your identity and citizenship.

- Proof of Residence: This could be a utility bill, bank statement, or other official documents.

- Tax Identification Number (TIN): As a foreigner, you'll need to obtain a TIN from the IRS.

- Bank Account: To fund your stock account and receive dividends.

The Application Process

Once you've chosen a brokerage firm and gathered the necessary documents, you can begin the application process. This usually involves completing an online application form and submitting your documents. Some brokerage firms may require a phone call or in-person meeting to verify your identity.

Understanding the Risks

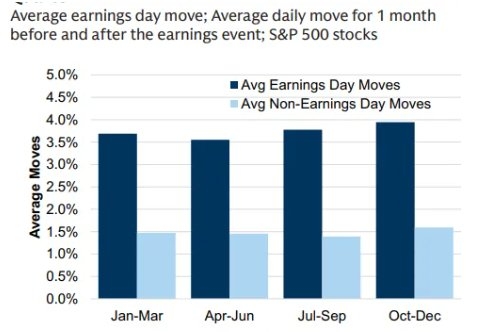

Before investing, it's crucial to understand the risks involved. The stock market can be volatile, and there's always a risk of losing money. It's important to do your research and invest only what you can afford to lose.

Investment Strategies

As a foreign investor, you have access to a wide range of US stocks, including blue-chip companies, small-cap stocks, and international stocks. Some popular investment strategies include:

- Dividend Stocks: These are stocks that pay regular dividends to shareholders.

- Growth Stocks: These are stocks of companies with high growth potential.

- Index Funds: These funds track a specific index, such as the S&P 500.

Case Study: John from Japan

Let's consider a case study involving John, a Japanese investor looking to open a stock account in the US. After researching various brokerage firms, John decided to go with E*TRADE. He gathered his documents, completed the application, and received his account within a few days.

John invested in a mix of dividend stocks and growth stocks, and over time, his portfolio grew significantly. He even received dividends and reinvested them, which further increased his investment.

Conclusion

Opening a stock account in the US as a foreigner is a straightforward process. By following this guide, you can navigate the process with confidence and start investing in the US stock market. Remember to do your research, understand the risks, and invest wisely.

Understanding the Dow Jones US Mid Cap Tota? us stock market today