In the ever-evolving world of finance, share trading has become a popular way for individuals to grow their wealth. However, navigating the stock market can be overwhelming, especially for beginners. This article aims to provide you with valuable share trading ideas that can help you make informed decisions and maximize your returns.

Understanding the Basics

Before diving into specific trading strategies, it's crucial to understand the basics of share trading. Share trading involves buying and selling stocks, which represent ownership in a company. The goal is to buy shares at a low price and sell them at a higher price, thereby making a profit.

Long-Term vs. Short-Term Trading

One of the first decisions you'll need to make is whether you want to engage in long-term trading or short-term trading. Long-term traders typically hold onto their shares for several months or even years, while short-term traders buy and sell shares within a matter of days or weeks.

Long-Term Trading Ideas

For those interested in long-term trading, here are a few share trading ideas to consider:

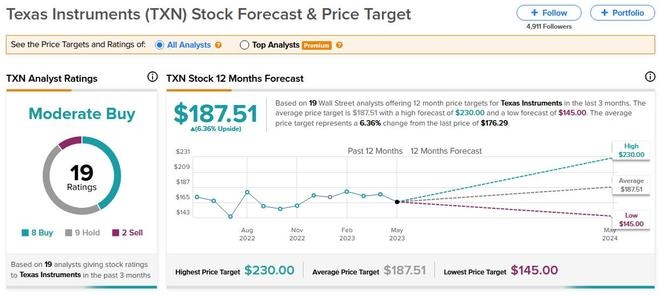

- Dividend Stocks: These are stocks that pay regular dividends to shareholders. Companies with a strong track record of paying dividends are often considered safe investments.

- Blue-Chip Stocks: Blue-chip stocks are shares of well-established companies with a long history of profitability and stability. These stocks tend to be less volatile than other types of stocks.

- Sector Rotation: This strategy involves shifting your investments among different sectors of the economy, such as technology, healthcare, or finance, based on market trends.

Short-Term Trading Ideas

If you prefer short-term trading, here are some share trading ideas to keep in mind:

- Intraday Trading: This involves buying and selling shares within the same trading day. It requires quick decision-making and a keen understanding of market trends.

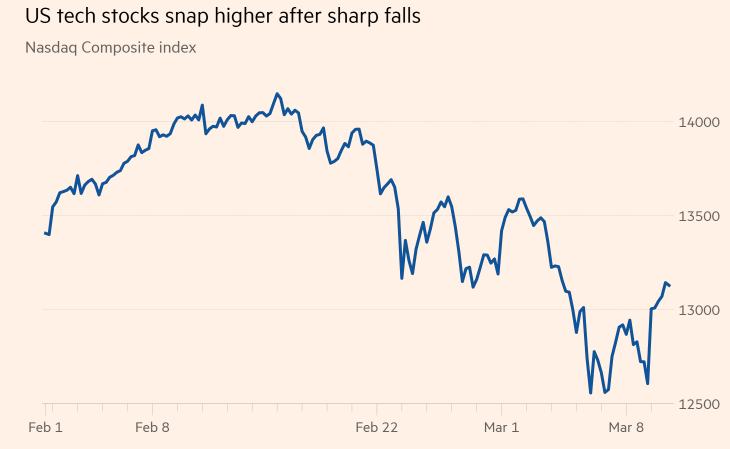

- Technical Analysis: This involves analyzing historical price and volume data to identify patterns and trends that can predict future price movements.

- News and Events: Staying informed about upcoming news and events that can impact the stock market is crucial for successful short-term trading.

Case Study: Apple Inc.

Let's consider a hypothetical example of how these share trading ideas could be applied. Suppose you believe that Apple Inc. (AAPL) is poised for significant growth. As a long-term investor, you could purchase shares at a low price and hold onto them for several years, benefiting from the company's strong dividend payments and consistent performance.

Alternatively, as a short-term trader, you might use technical analysis to identify a trend in Apple's stock price. By buying shares at a low price and selling them at a higher price within a few days, you could make a profit.

Conclusion

Share trading can be a powerful tool for building wealth, but it requires careful planning and research. By understanding the basics of share trading and incorporating the share trading ideas outlined in this article, you can increase your chances of success. Remember to stay informed, manage your risks, and always seek professional advice when needed.

Japan-US Stock Market: A Comprehensive Guid? us stock market today