In the heart of the global financial landscape, the U.S. financial markets stand as a beacon of innovation and stability. This article delves into the intricate workings of these markets, exploring their history, key players, and the factors that influence their performance. Whether you're a seasoned investor or a beginner looking to understand the basics, this comprehensive guide will provide valuable insights into the U.S. financial markets.

A Brief History of U.S. Financial Markets

The U.S. financial markets have a rich history that dates back to the early 18th century. The New York Stock Exchange (NYSE), established in 1792, is one of the oldest and most influential stock exchanges in the world. Over the years, the U.S. markets have evolved, adapting to changing economic conditions and technological advancements.

Key Players in the U.S. Financial Markets

The U.S. financial markets are dominated by several key players, including:

- Stock Exchanges: The NYSE, NASDAQ, and the American Stock Exchange (AMEX) are the three major stock exchanges in the U.S. Each has its unique characteristics and listings.

- Brokers and Dealers: These intermediaries facilitate the buying and selling of securities on behalf of investors.

- Investment Banks: These institutions provide a range of services, including underwriting, mergers and acquisitions, and advisory services.

- Regulatory Bodies: The Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) regulate the U.S. financial markets to ensure fair and transparent trading.

Factors Influencing U.S. Financial Markets

Several factors influence the performance of the U.S. financial markets:

- Economic Indicators: Data such as GDP, unemployment rates, and inflation rates provide insights into the overall health of the economy.

- Political Events: Elections, policy changes, and international relations can impact market sentiment.

- Technological Advancements: Innovations in technology can lead to new investment opportunities and disrupt traditional markets.

Types of Securities Traded in U.S. Financial Markets

The U.S. financial markets offer a wide range of securities, including:

- Stocks: Represent ownership in a company and are traded on stock exchanges.

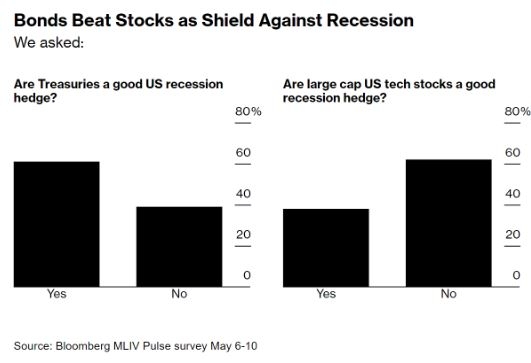

- Bonds: Issued by governments and corporations, bonds are debt instruments that pay interest to investors.

- Mutual Funds: Pooled investments managed by professionals, offering diversification and professional management.

- Exchange-Traded Funds (ETFs): Similar to mutual funds, ETFs are traded on stock exchanges and offer exposure to a basket of assets.

Case Study: The 2008 Financial Crisis

One of the most significant events in the history of the U.S. financial markets was the 2008 financial crisis. The crisis was triggered by the collapse of the housing market, which led to a wave of mortgage defaults and the subsequent failure of several major financial institutions. The crisis highlighted the importance of regulatory oversight and the need for transparency in the financial markets.

Conclusion

The U.S. financial markets are a complex and dynamic ecosystem that plays a crucial role in the global economy. Understanding the factors that influence these markets and the types of securities available can help investors make informed decisions. As the markets continue to evolve, staying informed and adapting to changes is key to success.

http stocks.us.reuters.com stocks fulldescr? us stock market today