In the ever-evolving world of finance, the local stock market has emerged as a crucial component for investors seeking to diversify their portfolios. This article delves into the intricacies of the local stock market, highlighting its unique opportunities and challenges. By understanding the local market dynamics, investors can make informed decisions and potentially reap substantial returns.

Understanding the Local Stock Market

The local stock market refers to the exchange where shares of companies based within a specific geographic region are traded. Unlike international markets, which often involve companies from various countries, the local market focuses on domestic businesses. This concentration offers several advantages, including:

- Greater Understanding of Local Businesses: Investors who are familiar with the local business landscape can gain a deeper insight into the operations and performance of companies listed on the local stock market.

- Reduced Currency Risk: Investing in the local stock market eliminates the need to worry about currency fluctuations, as all transactions are conducted in the domestic currency.

- Potential for Higher Returns: Local markets often offer higher growth rates compared to more mature international markets, providing investors with the opportunity to capitalize on emerging trends and innovations.

Navigating the Local Stock Market

While the local stock market presents numerous opportunities, it also comes with its own set of challenges. Here are some key factors to consider:

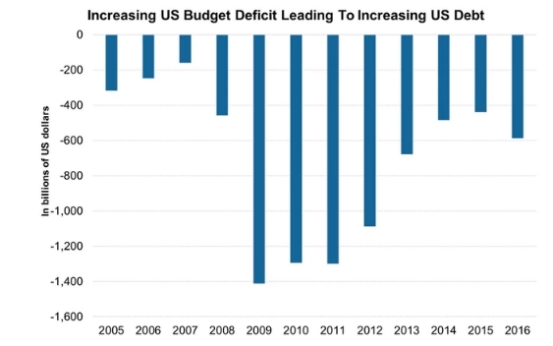

- Market Volatility: Local markets can be more volatile due to factors such as political instability, economic fluctuations, and regulatory changes.

- Limited Diversity: The local stock market may have a limited number of companies, which can restrict investment options and increase the risk of overexposure to a single sector.

- Lack of Information: Compared to international markets, the local market may have less access to information, making it more challenging to conduct thorough research.

Finding Success in the Local Stock Market

To succeed in the local stock market, investors should:

- Conduct Thorough Research: Before investing, it's crucial to research the companies listed on the local stock market, including their financial performance, management team, and market position.

- Diversify Your Portfolio: To mitigate risk, consider diversifying your investments across different sectors and industries.

- Stay Informed: Keep up-to-date with local economic and political developments, as these can significantly impact the stock market.

Case Study: The Rise of Technology Stocks in the Local Market

One notable example of success in the local stock market is the rise of technology stocks. As the technology sector has grown, companies like Tech Innovations Inc. have seen their stock prices soar. By investing in these companies early on, investors have reaped substantial returns.

In conclusion, the local stock market offers a wealth of opportunities for investors looking to diversify their portfolios and capitalize on domestic growth. By understanding the market dynamics and conducting thorough research, investors can navigate the local stock market and potentially achieve impressive returns.

US Stock Earnings Calendar 2025: A Comprehe? us stock market today