Diving into the world of finance, the Dow Jones Industrial Average (DJIA) serves as a critical barometer of the stock market's health. Over the past decade, this index has undergone significant transformations, offering valuable insights into the broader economic landscape. In this article, we'll explore the 10-year Dow Jones chart, highlighting key trends, market dynamics, and potential future implications.

Rising from the Ashes: The Recovery Post-2008

The year 2008 marked a historic low for the DJIA, with the global financial crisis leading to a sharp downturn in the stock market. However, the past decade has seen a remarkable recovery, with the index surging to record highs. The 10-year Dow Jones chart reveals a gradual ascent, with several notable milestones along the way.

Key Trends and Market Dynamics

Tech Stocks Take Center Stage: Over the past decade, technology stocks have played a pivotal role in the DJIA's rise. Companies like Apple, Microsoft, and Amazon have seen their shares soar, contributing significantly to the index's performance. This trend underscores the growing influence of the tech industry on the broader market.

Dividend-Paying Stocks: Another crucial factor driving the DJIA's growth has been the presence of dividend-paying stocks. These companies, known for their stability and consistent returns, have provided investors with a reliable source of income during turbulent times.

Interest Rate Fluctuations: The Federal Reserve's interest rate decisions have had a substantial impact on the DJIA. Over the past decade, the central bank has implemented several rate hikes and cuts, affecting the performance of the index. The 10-year Dow Jones chart showcases the correlation between interest rate changes and market movements.

Political and Economic Uncertainties: Political events and economic uncertainties have posed challenges to the DJIA's growth. The US-China trade war, Brexit, and the COVID-19 pandemic have all contributed to volatility in the market. However, the index has managed to recover and set new highs in the face of these challenges.

Case Study: Apple's Role in the DJIA

To illustrate the impact of key trends on the DJIA, let's take a closer look at Apple's performance over the past decade. Since joining the index in 2015, Apple has become one of its most influential components. Its shares have surged by nearly 500% over the past five years, significantly boosting the DJIA's overall performance.

Looking Ahead: Future Implications

As we look ahead, several factors could influence the DJIA's trajectory in the coming years. These include geopolitical tensions, economic growth prospects, and technological advancements. While the past decade has been marked by growth, the future may bring unforeseen challenges and opportunities.

In conclusion, the 10-year Dow Jones chart provides a fascinating insight into the market's evolution over the past decade. From the recovery post-2008 to the rise of tech stocks, this chart highlights the key trends and market dynamics that have shaped the DJIA. As investors and market participants, understanding these factors is crucial in navigating the ever-changing landscape of the financial markets.

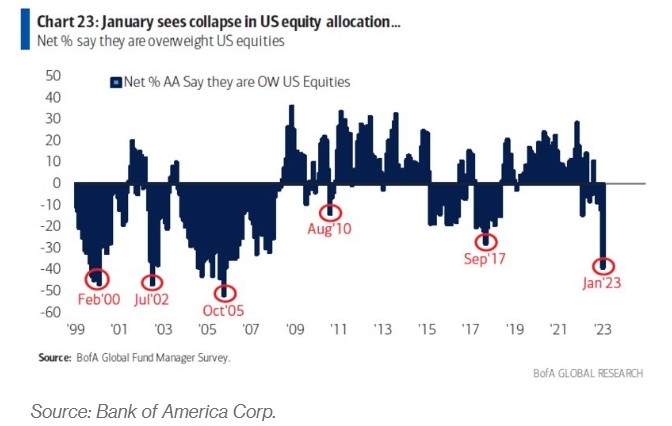

Rick to Us Stocks: Unveiling the Potential ? us stock market today live cha