In the tumultuous world of investing, determining whether a stock is a "buy" can be a daunting task. Today, we're focusing on U.S. Steel (NYSE: X), a company with a storied past and a promising future. In this article, we'll delve into the factors that make U.S. Steel an intriguing investment opportunity.

Understanding U.S. Steel

U.S. Steel Corporation, founded in 1901, is one of the oldest and largest integrated steel producers in the United States. The company operates in three primary segments: Flat-rolled Products, tubular products, and raw materials. U.S. Steel is known for its high-quality steel products, which are used in a variety of industries, including automotive, construction, and energy.

Recent Performance

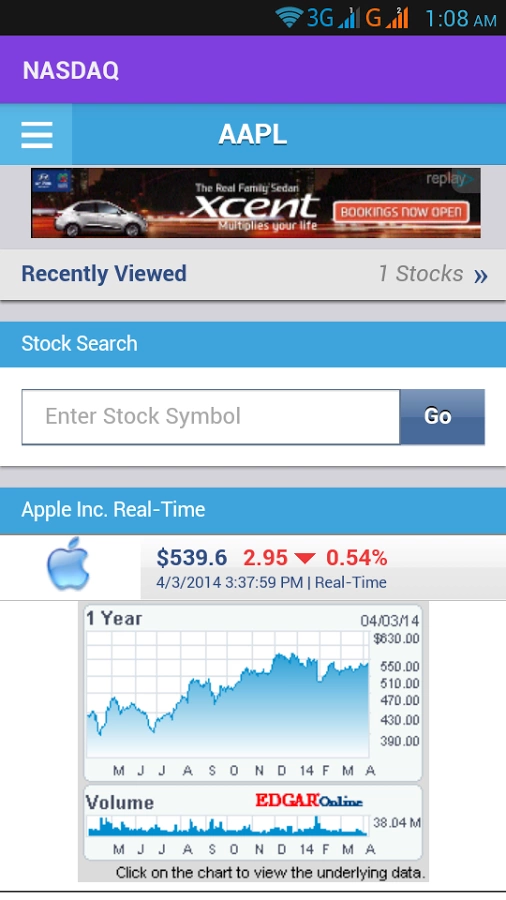

In the past year, U.S. Steel has seen its stock price fluctuate significantly. However, the company has managed to maintain a strong financial position. According to their latest earnings report, U.S. Steel reported a net income of

Factors to Consider

1. Strong Market Demand

The demand for steel has been on the rise in recent years, driven by a recovering construction industry and increased investments in infrastructure. This has translated into higher steel prices, which have been a boon for U.S. Steel.

2. Diversified Revenue Streams

U.S. Steel's business model is diversified, with operations in multiple segments. This reduces the company's vulnerability to market fluctuations in any single segment.

3. Investment in New Technologies

U.S. Steel has been investing heavily in new technologies and processes to improve efficiency and reduce costs. This commitment to innovation is likely to pay off in the long run.

4. Strong Management Team

The company is led by a seasoned management team with a proven track record in the steel industry. This expertise is crucial in navigating the challenges and opportunities that lie ahead.

5. Dividend Yield

U.S. Steel offers a dividend yield of 2.6%, which is higher than the average yield for the steel industry.

Case Study: Nucor Corporation

For a comparative analysis, let's look at Nucor Corporation (NYSE: NUE), another leading steel company. While Nucor has a strong reputation for innovation and efficiency, U.S. Steel's current valuation and dividend yield make it a more attractive investment option.

Conclusion

In conclusion, U.S. Steel Corporation presents a compelling investment opportunity. The company's strong financial performance, diversified revenue streams, and commitment to innovation make it a solid choice for investors looking to invest in the steel industry. With a promising outlook and a strong management team, U.S. Steel is undoubtedly a "buy" for those with a long-term investment horizon.

Dow Jones Industrial Average Live Today: La? us stock market today live cha