As we delve into October 2025, investors and financial analysts alike are closely examining the current state of the US stock market valuation. The market's trajectory has been a subject of much speculation and analysis, and with the changing economic climate, it's essential to understand the valuation landscape. This article will provide a comprehensive overview of the current US stock market valuation, highlighting key trends, factors impacting the market, and potential investment opportunities.

Stock Market Valuation Basics

To begin, it's important to understand the concept of stock market valuation. Essentially, it refers to the process of determining the intrinsic value of a stock or the overall market. Valuation can be based on various methods, including price-to-earnings (P/E) ratios, price-to-book (P/B) ratios, and discounted cash flow (DCF) analysis. These methods help investors and analysts gauge whether a stock or the market is overvalued, undervalued, or fairly valued.

Current Market Trends

As of October 2025, the US stock market has been exhibiting several key trends. One significant trend is the divergence between large-cap and small-cap stocks. Large-cap companies, such as Apple, Microsoft, and Amazon, have been performing well, with their stock prices increasing significantly. In contrast, small-cap stocks have underperformed, leading to a widening gap between the two segments.

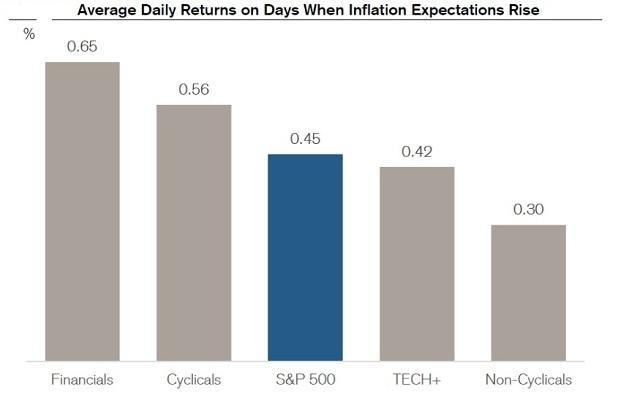

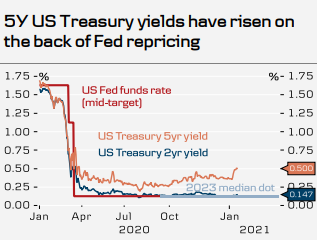

Another trend is the rising interest rates. The Federal Reserve has been gradually increasing interest rates to control inflation, which has had a negative impact on stocks, particularly in sectors like technology and real estate. However, some investors believe that higher interest rates could eventually lead to a more sustainable economic growth, which would benefit the stock market in the long term.

Factors Influencing Valuation

Several factors have influenced the current US stock market valuation. Here are some of the key factors to consider:

- Economic Growth: The overall economic environment plays a significant role in stock market valuation. As the economy grows, companies generate higher revenues and profits, leading to increased stock prices.

- Interest Rates: As mentioned earlier, interest rates have a direct impact on stock valuations. Higher interest rates can lead to higher borrowing costs for companies, which may negatively impact their profitability and stock prices.

- Inflation: Inflation can erode the purchasing power of investors' returns. High inflation may lead to lower stock valuations as companies struggle to maintain their profit margins.

- Technological Advancements: Technological advancements can drive innovation and create new industries, leading to increased stock valuations. Conversely, outdated technologies can lead to obsolescence and declining stock prices.

Case Studies

To illustrate the impact of valuation on specific companies, let's consider two case studies:

- Apple Inc.: Apple has consistently outperformed the market over the years, largely due to its strong brand and innovative products. The company's stock valuation has been supported by its high earnings growth, strong cash flow, and dominant market position.

- Tesla, Inc.: Tesla has seen significant growth since its inception, driven by its leadership in the electric vehicle (EV) market. Despite the company's high valuation, some investors believe that Tesla's potential for growth justifies its price.

Conclusion

As we approach October 2025, the US stock market valuation presents a complex landscape. Understanding the current trends, factors influencing valuation, and potential opportunities is crucial for investors seeking to make informed decisions. While the market remains unpredictable, a comprehensive understanding of these factors can help investors navigate the challenges and capitalize on opportunities in the stock market.

Understanding the Power of iShares Core S&a? us stock market today live cha