Are you considering investing in the U.S. stock market but confused about dividends? You're not alone. Many investors often wonder if stocks in the United States provide dividend payments. In this article, we'll explore the concept of dividends, how they work, and why they are an essential component of a well-diversified investment portfolio.

What are Dividends?

Dividends are payments made by a company to its shareholders, typically out of its profits. They are a way for companies to share their success with investors who have purchased their stocks. Dividends can be in the form of cash or additional shares of stock, known as stock dividends.

Types of Dividends

Cash Dividends: This is the most common type of dividend, where shareholders receive cash payments directly into their accounts.

Stock Dividends: In this scenario, a company issues additional shares of its stock to existing shareholders, rather than distributing cash.

Property Dividends: This involves distributing physical assets, such as real estate or equipment, to shareholders.

Do All U.S. Stocks Give Dividends?

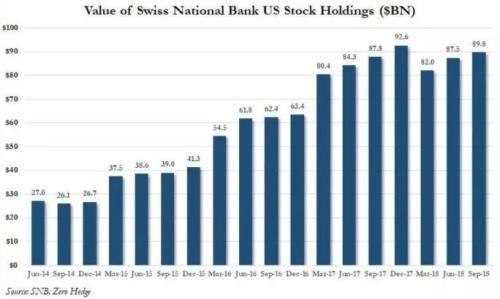

Not all U.S. stocks provide dividends. Many growth stocks, which are typically younger and have higher potential for future earnings, do not pay dividends. These companies reinvest their earnings back into the business to fuel growth.

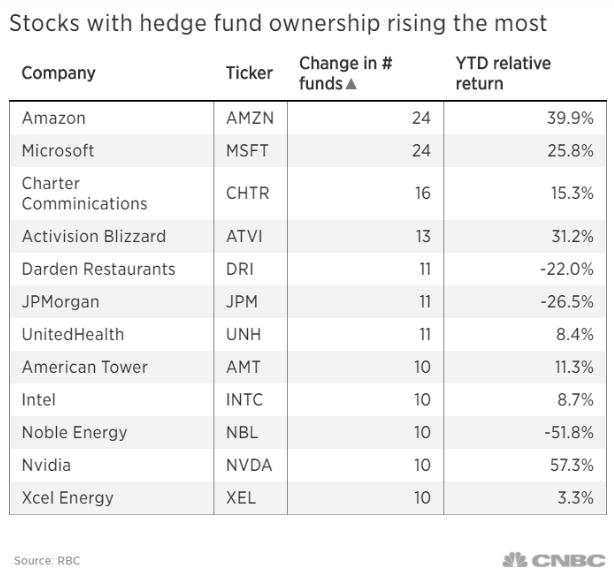

However, there are numerous well-established companies across various industries that offer dividend payments. These include utilities, consumer goods, and financial services companies.

Why Invest in Dividend-Paying Stocks?

Income Stream: Dividends provide a regular income stream, which is particularly beneficial for retired investors or those relying on investment income.

Long-Term Growth: Dividend-paying stocks often have a track record of stability and consistent growth, making them a solid long-term investment.

Dividend Reinvestment: Many brokers offer dividend reinvestment plans, allowing investors to automatically reinvest their dividends back into more shares of the company.

Case Study: Procter & Gamble (PG)

An excellent example of a company that consistently pays dividends is Procter & Gamble (PG). Since 1890, PG has paid a dividend to its shareholders, making it one of the oldest companies in the S&P 500 to do so. Over the years, PG has increased its dividend payments, demonstrating its commitment to rewarding shareholders.

Conclusion

In conclusion, while not all U.S. stocks provide dividends, many well-established companies do. Dividends can be an important source of income and a sign of a company's stability and growth potential. When considering your investment strategy, it's crucial to understand the role dividends can play in your portfolio.

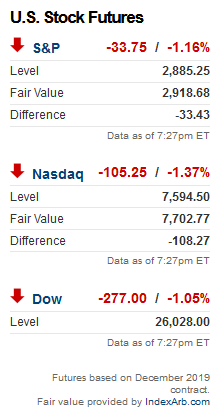

"Black Monday 2019: The US Stock M? us stock market today live cha