In today's fast-paced financial world, understanding how to share stocks is a crucial skill for any investor. Whether you're a seasoned trader or just starting out, this comprehensive guide will provide you with the knowledge and strategies needed to effectively share stocks and potentially maximize your returns.

Understanding Share Stocks

Before diving into the nitty-gritty of sharing stocks, it's essential to have a clear understanding of what they are. Share stocks, also known as equity shares, represent ownership in a company. When you purchase shares, you become a partial owner of that company, entitling you to a portion of its profits and assets.

The Benefits of Sharing Stocks

One of the primary benefits of sharing stocks is the potential for significant returns. As a shareholder, you have the opportunity to benefit from the company's growth and success. This can be achieved through dividends, which are payments made to shareholders from the company's profits, and capital gains, which occur when the value of your shares increases over time.

How to Share Stocks

1. Research and Select Companies

The first step in sharing stocks is to research and select companies that align with your investment goals and risk tolerance. Look for companies with strong financials, a solid track record, and a promising future outlook. Tools like financial ratios, market trends, and expert analysis can help you make informed decisions.

2. Open a Brokerage Account

To share stocks, you'll need a brokerage account. This account allows you to buy and sell shares of stock. When choosing a brokerage, consider factors such as fees, customer service, and available investment options. Some popular brokerage platforms include TD Ameritrade, E*TRADE, and Charles Schwab.

3. Place Your Order

Once you have your brokerage account set up, you can place your order to buy shares. This can be done through your brokerage's online platform or by calling a customer service representative. Be sure to specify the number of shares you want to buy and the maximum price you're willing to pay.

4. Monitor Your Investments

After purchasing shares, it's crucial to monitor your investments regularly. Keep an eye on the company's financial performance, market trends, and any news that could impact the stock's value. This will help you make informed decisions about when to buy, sell, or hold onto your shares.

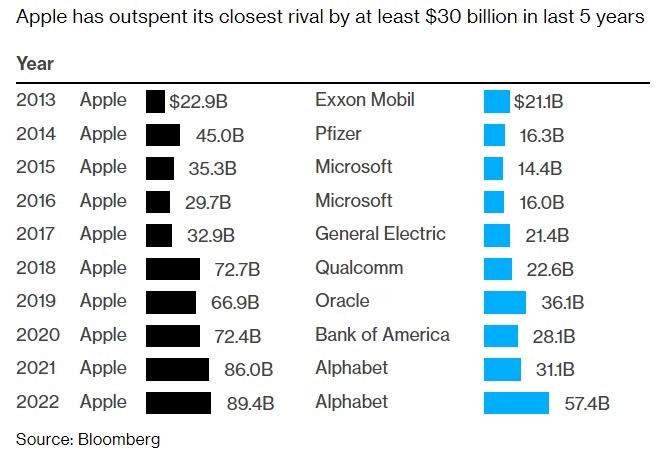

Case Study: Apple Inc.

A prime example of a successful stock to share is Apple Inc. (AAPL). Since its initial public offering (IPO) in 1980, Apple has grown to become one of the world's most valuable companies. By investing in Apple shares, investors have seen substantial returns over the years, making it a popular choice for those looking to share stocks.

Conclusion

Sharing stocks can be a powerful tool for building wealth and achieving financial goals. By understanding the basics, conducting thorough research, and staying informed, you can make informed decisions and potentially maximize your returns. Remember, investing in the stock market always carries risks, so it's important to do your due diligence and consider your risk tolerance before diving in.

Buy Us Oil Stock: A Smart Investment Opport? us stock market today live cha