Are you a Mexican investor looking to expand your portfolio into the United States? Buying US stocks from Mexico can be a great way to diversify your investments and potentially earn higher returns. In this article, we will provide you with a comprehensive guide on how to buy US stocks from Mexico, including the necessary steps, tools, and considerations to keep in mind.

Understanding the Process

The first step in buying US stocks from Mexico is to understand the process. Here’s a breakdown of the key steps you need to follow:

Open a Brokerage Account: To buy US stocks, you need to open a brokerage account with a reputable online brokerage firm. Many brokerage firms offer accounts to international investors, so make sure to choose one that accepts Mexican clients.

Research and Select Stocks: Once you have your brokerage account, research and select the US stocks you want to invest in. Consider factors such as the company’s financial health, industry trends, and market conditions.

Convert Currency: Since you are purchasing US stocks from Mexico, you will need to convert Mexican pesos to US dollars. This can be done through your brokerage firm or a currency exchange service.

Place Your Order: After converting your currency, place your order through your brokerage account. You can choose to buy stocks at the current market price or set a limit order to buy at a specific price.

Monitor Your Investments: Once your order is executed, monitor your investments regularly to stay informed about the performance of your stocks and make informed decisions.

Tools and Resources

To successfully buy US stocks from Mexico, you will need access to certain tools and resources:

Online Brokerage Platform: Choose a reliable online brokerage platform that offers easy-to-use tools for research, analysis, and trading.

Financial News and Analysis: Stay updated with the latest financial news and analysis to make informed investment decisions. Many websites and publications offer free or paid subscriptions for this purpose.

Currency Exchange Services: If your brokerage firm does not offer currency exchange services, you can use a reputable currency exchange service to convert Mexican pesos to US dollars.

Considerations for Mexican Investors

When buying US stocks from Mexico, there are several considerations to keep in mind:

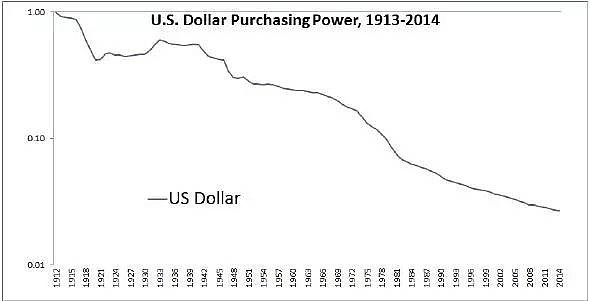

Currency Fluctuations: Be aware of the risks associated with currency fluctuations, as they can impact the value of your investments.

Tax Implications: Understand the tax implications of investing in US stocks from Mexico. Consult with a tax professional to ensure compliance with Mexican and US tax laws.

Regulatory Compliance: Make sure that your brokerage firm is regulated and authorized to operate in both Mexico and the United States.

Investment Strategy: Develop a well-thought-out investment strategy that aligns with your financial goals and risk tolerance.

Case Study: Investing in Apple (AAPL)

Let’s consider a hypothetical scenario where a Mexican investor wants to buy shares of Apple Inc. (AAPL). Here’s how they can go about it:

Open a Brokerage Account: The investor opens a brokerage account with a reputable online brokerage firm that accepts Mexican clients.

Research and Select Stocks: The investor conducts thorough research on Apple’s financial health, industry trends, and market conditions.

Convert Currency: The investor converts Mexican pesos to US dollars through their brokerage firm or a currency exchange service.

Place Your Order: The investor places a market order to buy 100 shares of Apple at the current market price.

Monitor Your Investments: The investor monitors the performance of their investment regularly and adjusts their strategy as needed.

By following these steps and considerations, Mexican investors can successfully buy US stocks and diversify their portfolios. Remember to do thorough research and consult with a financial advisor to make informed investment decisions.

Goldman Strategists See US Stocks Losing Th? stock chap