In the vast landscape of the stock market, some pairings are as predictable as day and night. However, the combination of technology and utilities stocks often seems like an odd couple, each bringing its unique set of characteristics and challenges. This article delves into why tech and utilities stocks make an unusual pair in the world of investing, with a focus on their distinct features and the potential opportunities they offer.

Understanding the Odd Couple

To grasp the concept of tech and utilities stocks as an odd couple, it's crucial to understand the key characteristics of each sector.

Technology Stocks

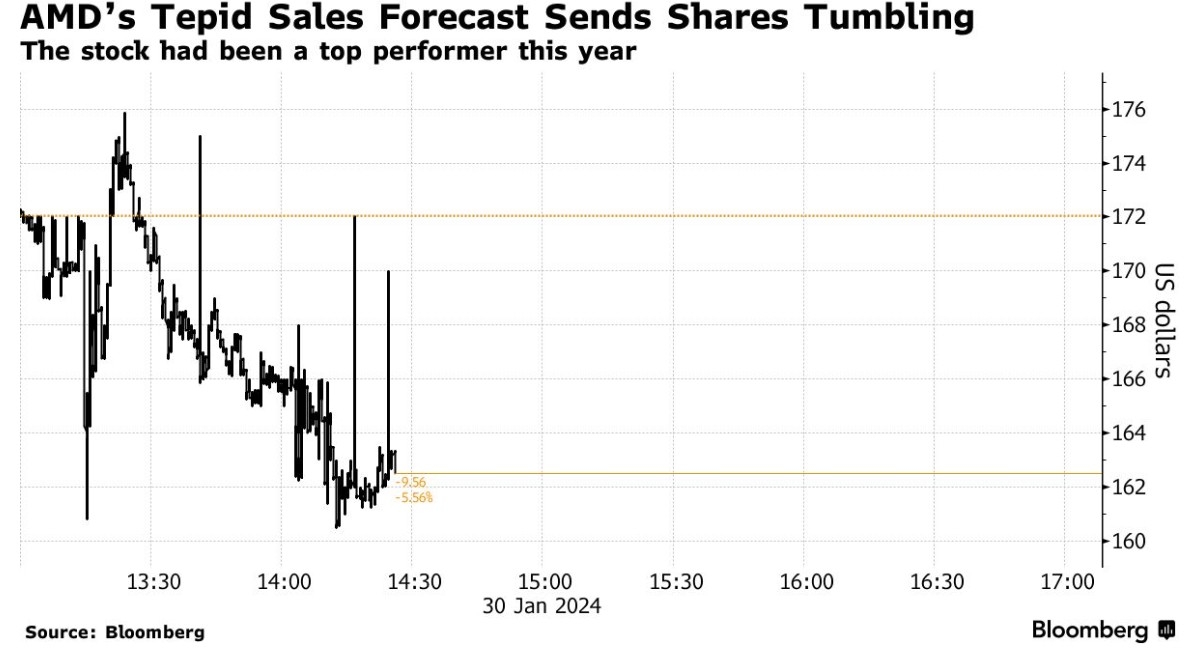

Technology stocks are known for their high growth potential, rapid innovation, and volatility. These companies operate in various segments, including software, hardware, telecommunications, and internet services. The tech industry is highly competitive, with constant innovation pushing companies to the forefront of technological advancements.

Utilities Stocks

On the other hand, utilities stocks represent the energy sector, including electricity, natural gas, and water. These companies typically provide essential services to consumers and businesses, ensuring a stable and predictable revenue stream. Utilities stocks are known for their low volatility, dividend yields, and stable cash flows.

The Odd Couple Dynamics

Despite their apparent differences, tech and utilities stocks have found a unique synergy in the stock market. Here are some reasons why they make an odd couple:

Diversification: By combining tech and utilities stocks in a portfolio, investors can achieve diversification. While technology stocks may experience significant volatility, utilities stocks provide stability and consistent returns.

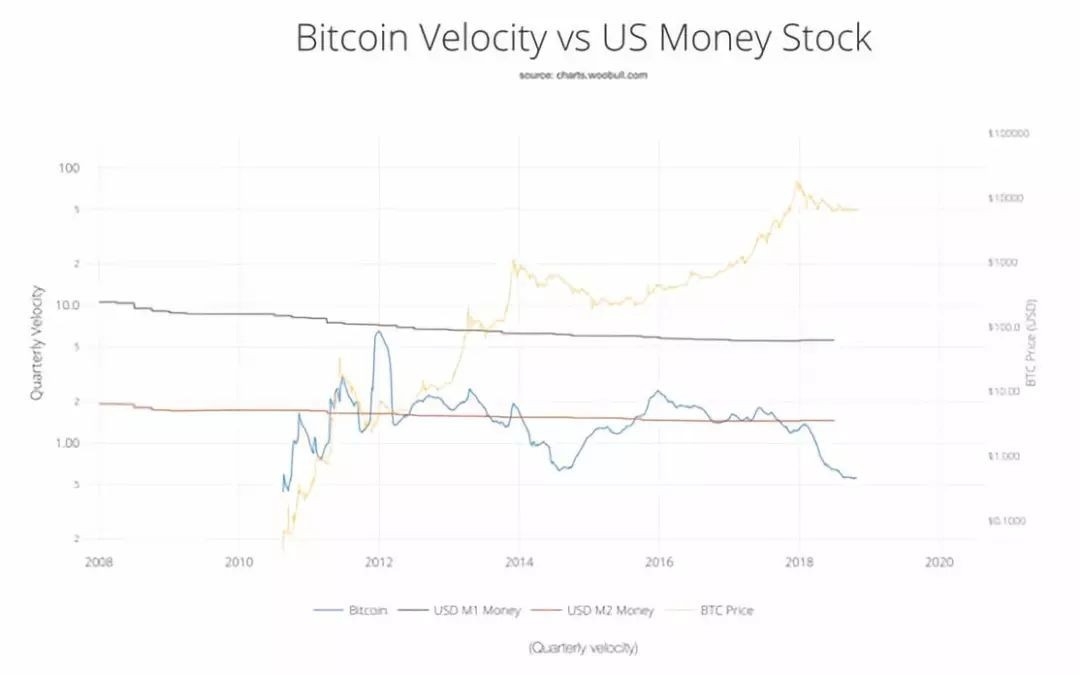

Innovation and Efficiency: Utilities companies are increasingly investing in technology to improve efficiency and reduce costs. This trend creates opportunities for tech companies to collaborate with utilities, leading to synergistic growth.

Regulatory Environment: The energy sector is heavily regulated, which can be seen as a double-edged sword. On one hand, it provides stability to utilities stocks. On the other hand, it can create barriers to entry for tech companies looking to disrupt the industry.

Case Studies

To illustrate the odd couple dynamics, let's look at a few case studies:

IBM and Duke Energy: IBM has been working with Duke Energy to implement advanced technologies, such as artificial intelligence and blockchain, to improve grid management and customer service.

Google and Pacific Gas & Electric (PG&E): Google has invested in renewable energy projects, such as solar and wind farms, to provide clean energy to utilities like PG&E.

Microsoft and Southern Company: Microsoft has partnered with Southern Company to develop smart grid technologies, which help optimize energy distribution and reduce costs.

Conclusion

In conclusion, tech and utilities stocks may seem like an odd couple, but they offer unique benefits for investors. By combining the high growth potential of technology with the stability and reliability of utilities, investors can create well-rounded portfolios. As technology continues to shape the energy sector, the odd couple dynamics are likely to persist, creating new opportunities for investors to capitalize on.

Unveiling the Power of Finance Yahoo: Your ? us stock market live