In a recent analysis, Goldman Sachs has warned that the outlook for US economic growth is becoming increasingly pessimistic. This shift in sentiment has raised questions about the future of the stock market. However, some experts believe that this souring outlook may actually create opportunities for savvy investors to find stocks at attractive prices.

Understanding the Shift in Growth Views

Goldman Sachs' downgrade of its US economic growth forecast has been a significant event in the financial world. The firm now expects the US economy to grow at a slower pace than previously anticipated. This change in outlook is primarily driven by concerns about rising inflation, geopolitical tensions, and the potential for a global economic slowdown.

Impact on the Stock Market

The souring growth views have had a notable impact on the stock market. Many investors have become increasingly cautious, leading to a sell-off in some sectors. However, this sell-off has also created opportunities for those who are willing to look for undervalued stocks.

Finding Bargains in the Market

According to Goldman Sachs, the souring growth views may lead to a more favorable environment for value investors. As the market adjusts to the new reality, some stocks that have been overlooked or undervalued may start to attract attention.

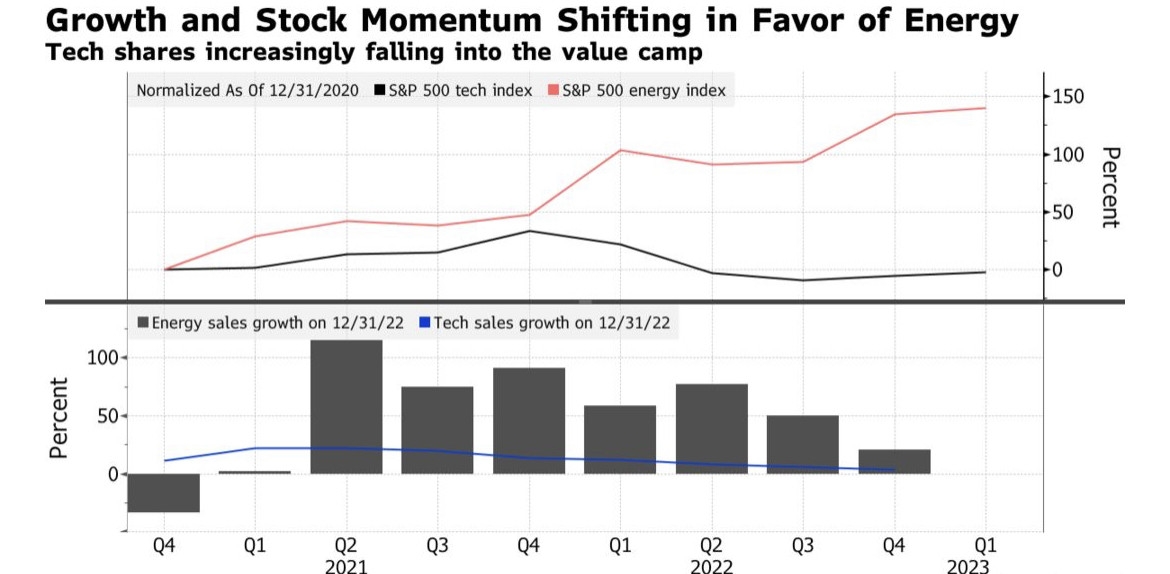

Case Study: Technology Sector

One sector that has been particularly affected by the souring growth views is the technology sector. Companies like Apple and Microsoft, which have been among the market leaders, have seen their stock prices decline. However, some experts believe that this may be an opportunity for investors to buy into these companies at more attractive valuations.

Key Considerations for Investors

While the souring growth views may create opportunities for value investors, it's important to approach the market with caution. Here are some key considerations for investors looking to capitalize on these potential bargains:

- Thorough Research: It's crucial to conduct thorough research before investing in any stock. This includes analyzing the company's financials, competitive position, and growth prospects.

- Diversification: Diversifying your portfolio can help mitigate risks associated with investing in specific sectors or individual stocks.

- Long-Term Perspective: It's important to maintain a long-term perspective when investing. Avoid making impulsive decisions based on short-term market movements.

Conclusion

The souring growth views from Goldman Sachs may seem daunting at first glance. However, for those who are willing to look for opportunities, this shift in sentiment may actually create attractive bargains in the stock market. By conducting thorough research, maintaining a diversified portfolio, and maintaining a long-term perspective, investors can potentially capitalize on these opportunities.

Unlocking the Potential of Large US Equity ? us stock market today