Embarking on the journey to invest in US stocks from Malaysia can be an exciting opportunity for growth and diversification. With the rise of online trading platforms, purchasing American shares has never been easier. This guide will walk you through the essential steps to help you successfully invest in US stocks from Malaysia.

Choose a Reliable Broker

The first step in buying US stocks from Malaysia is selecting a reliable brokerage firm. It is crucial to choose a broker that offers excellent customer service, competitive fees, and access to a wide range of US stocks. Some popular brokerage firms for Malaysians include TD Ameritrade, E*TRADE, and Charles Schwab.

Understand the Risks

Investing in US stocks involves risks, including currency exchange rates, political instability, and market fluctuations. Before you start investing, ensure you understand the risks involved and develop a sound investment strategy.

Open an Account

Once you have chosen a broker, the next step is to open an account. You will need to provide some personal information, such as your name, address, and tax identification number. The brokerage firm will also require proof of identity, such as a government-issued ID.

Fund Your Account

After your account is opened, you will need to fund it with cash or other securities. The funds can be transferred from your local bank account or credit card. It's important to note that the transfer may take a few days, so plan accordingly.

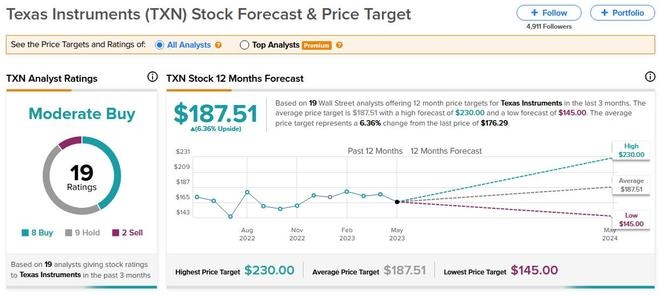

Research and Analyze

Before buying US stocks, conduct thorough research and analysis. Analyze the company's financial statements, industry trends, and market conditions. This will help you make informed investment decisions and reduce the risk of loss.

Choose Your Stocks

Based on your research and analysis, choose the US stocks that align with your investment goals and risk tolerance. Consider factors such as the company's growth potential, dividend yield, and valuation.

Place Your Order

Once you have selected your stocks, place your order through your brokerage platform. You can choose between market orders, which execute at the current market price, or limit orders, which allow you to specify a price at which you are willing to buy or sell.

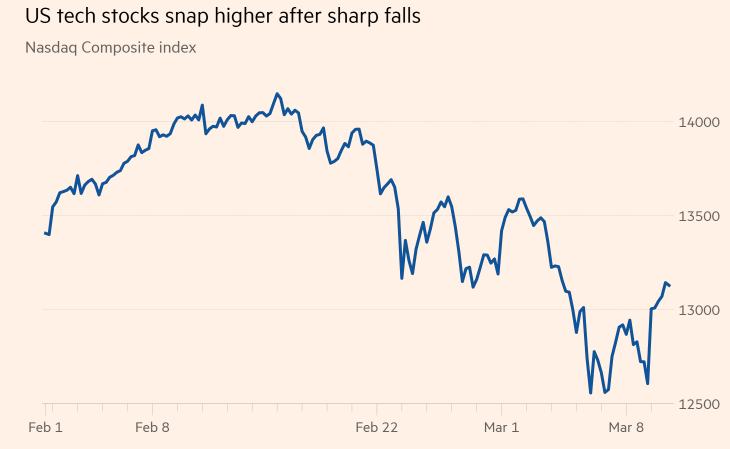

Monitor Your Investments

After purchasing US stocks, monitor your investments regularly. Stay informed about market trends, company news, and economic indicators that may impact your investments.

Case Study: ABC Corp

Let's consider a hypothetical case study of ABC Corp, a well-performing company listed on the US stock exchange. A Malaysian investor, Sarah, decided to invest in ABC Corp after conducting thorough research. She chose TD Ameritrade as her brokerage firm and successfully opened an account and funded it with cash. After analyzing the company's financials and industry trends, Sarah decided to buy 100 shares of ABC Corp at

By following these steps, you can successfully buy US stocks from Malaysia and potentially grow your investment portfolio. Remember to conduct thorough research, stay informed, and invest wisely.

Kazakh Stocks in the US Market: A Comprehen? us stock market today