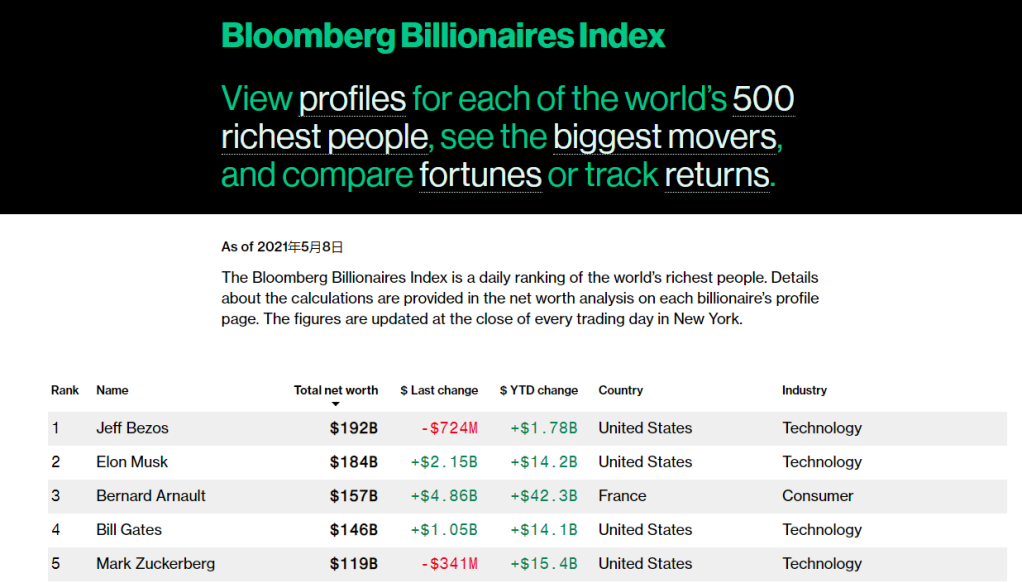

In the dynamic world of investing, the choice between international and US stocks is a pivotal decision for investors. As we delve into the year 2021, understanding the nuances of these two markets becomes crucial. This article aims to provide a comprehensive analysis of international and US stocks, highlighting their key differences and offering insights into where investors might find better opportunities.

Market Dynamics in 2021

Last year was marked by a tumultuous yet rewarding period for investors. The global pandemic brought unprecedented challenges, but it also led to significant market movements. The US stock market, in particular, experienced a remarkable rally, with the S&P 500 Index surging over 16% in 2021. However, international markets also performed well, with some regions outpacing the US.

International Stocks: A Diverse Landscape

International stocks offer investors exposure to a wide range of markets, including Europe, Asia, and Latin America. These markets often have different economic structures and growth drivers, providing a diverse portfolio. For instance, European stocks tend to be more cyclically sensitive, while Asian markets are often driven by technological advancements.

US Stocks: The Land of Innovation

The US stock market, on the other hand, is renowned for its innovation and technological prowess. Companies like Apple, Amazon, and Microsoft dominate the global landscape, driving significant market movements. The US also has a strong regulatory environment, which provides stability and investor protection.

Key Differences in 2021

One of the most significant differences between international and US stocks in 2021 was the sector composition. The US market was heavily concentrated in technology and healthcare, while international markets had a more balanced sector distribution. This sector bias was influenced by various factors, including economic recovery trends and regulatory changes.

Performance Analysis

In terms of performance, the US market outperformed international markets in 2021. However, this trend may not necessarily continue in the future. For instance, some emerging markets in Asia and Latin America have shown strong growth potential, offering attractive opportunities for long-term investors.

Risk Considerations

Investors should also consider the risk profile of each market. The US market is generally considered less risky due to its stable economic environment and regulatory framework. However, international markets often offer higher growth potential but come with higher volatility and political risks.

Case Studies

To illustrate the differences between international and US stocks, let's consider two case studies:

Tesla (US): Tesla, a leading electric vehicle manufacturer, has seen its stock soar in the past few years. Its innovative technology and strong market position have made it a favorite among investors, contributing to the outperformance of the US market.

Naspers (South Africa): Naspers, a leading internet and e-commerce company in Africa, has seen significant growth in its stock price. Its expansion into various markets and strong performance in the technology sector have made it an attractive investment for international investors.

Conclusion

In conclusion, the choice between international and US stocks in 2021 depends on various factors, including market dynamics, sector composition, and risk tolerance. While the US market has performed well, international markets offer diverse opportunities and potential growth. Investors should conduct thorough research and consider their investment goals before making a decision.

"Low Volatility US Stocks to Watch? us stock market today