The US futures stock market today offers a glimpse into the potential movements of the equity markets. With the world's largest and most influential stock market, the US futures market is a key indicator of investor sentiment and market trends. In this article, we'll delve into the current state of the US futures market, exploring the factors influencing it and providing an analysis of the major indices.

Understanding the US Futures Market

The US futures market is a marketplace where traders can speculate on the future price of financial instruments such as stocks, bonds, commodities, and currencies. These futures contracts are agreements to buy or sell an asset at a predetermined price on a specific date in the future. The US futures market operates similarly to the cash market, but with the added benefit of allowing traders to hedge their risks.

Major Indices in Focus

As of today, the following major indices are being closely watched in the US futures market:

- S&P 500 (SPX): This index represents the 500 largest companies listed on the stock exchanges in the United States. It is often considered a bellwether for the overall market.

- Dow Jones Industrial Average (DJIA): Comprising 30 large, publicly-owned companies, this index is a measure of the performance of the stock market and is often used to gauge the health of the US economy.

- NASDAQ Composite (IXIC): This index tracks the performance of more than 3,200 companies listed on the NASDAQ, including many technology giants.

Factors Influencing the US Futures Market

Several factors can influence the US futures market today:

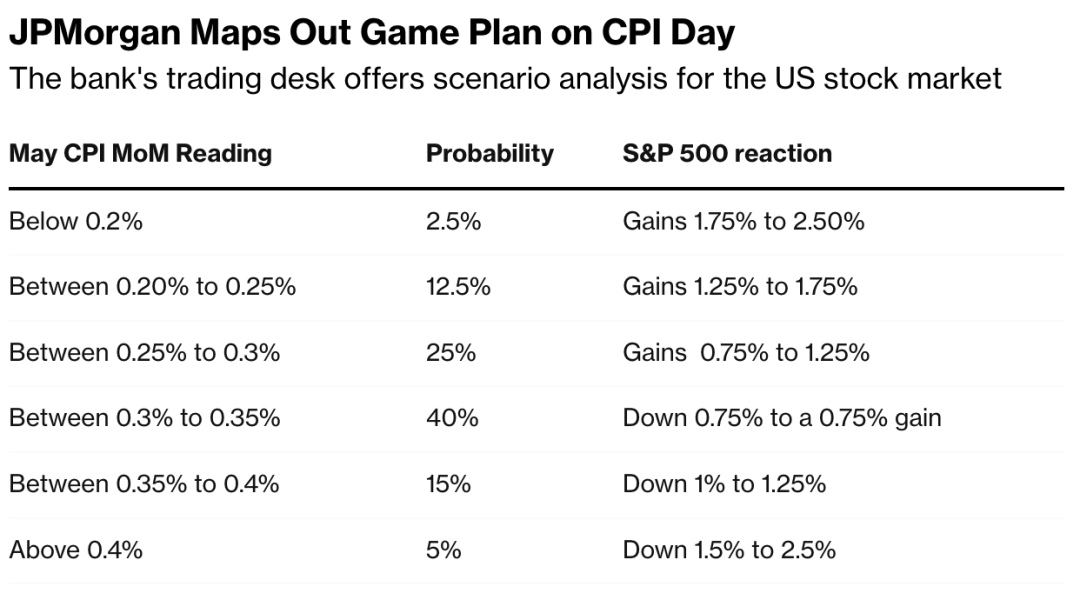

- Economic Data: Economic indicators such as unemployment rates, inflation, and GDP growth can have a significant impact on investor sentiment and the stock market.

- Political Events: Political events, both domestic and international, can create uncertainty and volatility in the markets.

- Interest Rates: The Federal Reserve's decisions on interest rates can affect borrowing costs and corporate earnings, thereby influencing stock prices.

- Technological Advances: Breakthroughs in technology can create new opportunities and disrupt existing industries, impacting the stock market.

Analysis of Current Market Trends

S&P 500 (SPX): The S&P 500 futures are currently showing a slight upward trend, indicating optimism in the market. This could be attributed to positive economic data and strong corporate earnings reports.

Dow Jones Industrial Average (DJIA): The DJIA futures are also showing a positive trend, with investors optimistic about the performance of major companies in the index.

NASDAQ Composite (IXIC): The NASDAQ futures, however, are displaying a more cautious stance, possibly due to concerns about the impact of rising interest rates on technology companies.

Case Study: Apple Inc. (AAPL)

Apple Inc., a major component of the NASDAQ Composite, has been a focus of attention in the US futures market. Despite the cautious trend in the NASDAQ futures, Apple's stock price has shown resilience, driven by strong demand for its products and robust earnings reports.

In conclusion, the US futures stock market today is showing a mix of optimism and caution. As investors continue to monitor economic data, political events, and technological advances, the market's trajectory will likely remain volatile. Traders and investors alike should stay informed and be prepared for potential market shifts.

Understanding the US Residential Housing St? us stock market today live cha